Joan and Matthew are married, have two children, and report the following items on their 2020 tax

Question:

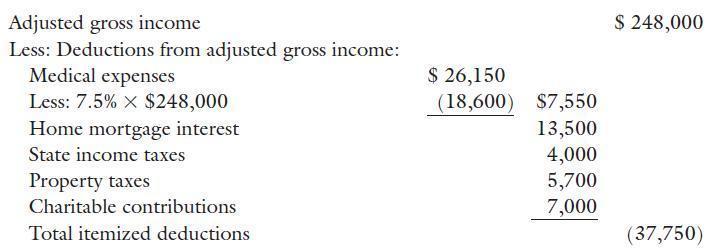

Joan and Matthew are married, have two children, and report the following items on their 2020 tax return:

Determine Joan and Matthew’s regular tax liability and, if applicable, the amount of their alternative minimum tax. Write a memo to Joan and Matthew explaining the adjustments they will have to make in computing their alternative minimum tax.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Concepts In Federal Taxation 2021

ISBN: 9780357141212

28th Edition

Authors: Kevin E. Murphy, Mark Higgins, Randy Skalberg

Question Posted: