Bongo Corporation was incorporated in 2018. It had no capital asset transactions in 2018. From 2019 through

Question:

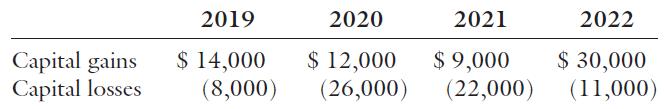

Bongo Corporation was incorporated in 2018. It had no capital asset transactions in 2018. From 2019 through 2022, Bongo has the following capital gains and losses:

Assuming that Bongo’s marginal tax rate during each of these years is 21%, what is the effect of Bongo’s capital gains and losses on the amount of tax due each year?

Transcribed Image Text:

2019 2020 2021 2022 Capital gains Capital losses $ 14,000 (8,000) $ 12,000 (26,000) $ 9,000 (22,000) $ 30,000 (11,000)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

The gains and losses must be netted together Net capital gains are subject to the corporate tax Net ...View the full answer

Answered By

Nyron Beeput

I am an active educator and professional tutor with substantial experience in Biology and General Science. The past two years I have been tutoring online intensively with high school and college students. I have been teaching for four years and this experience has helped me to hone skills such as patience, dedication and flexibility. I work at the pace of my students and ensure that they understand.

My method of using real life examples that my students can relate to has helped them grasp concepts more readily. I also help students learn how to apply their knowledge and they appreciate that very much.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Concepts In Federal Taxation 2021

ISBN: 9780357141212

28th Edition

Authors: Kevin E. Murphy, Mark Higgins, Randy Skalberg

Question Posted:

Students also viewed these Business questions

-

Bongo Corporation is incorporated in 2014. It has no capital asset transactions in 2014. From 2015 through 2018, Bongo has the following capital gains and losses: Assuming that Bongo's marginal tax...

-

Bongo Corporation is incorporated in 2009. It has no capital asset transactions in 2009. From 2010 through 2013, Bongo has the following capital gains and losses: Assuming that Bongos marginal tax...

-

The Seawall Corporation uses an injection molding machine to make a plastic product, Z39, after receiving firm orders from its customers. Seawall estimates that it will receive 50 orders for Z39...

-

When testing for a difference between the means of a treatment group and a group given a placebo, the following Excel display is obtained. Using a 0.02 significance level, is there sufficient...

-

Shown below is next year?s budget for the forming and finishing departments of Tooton Ltd. The departments manufacture three different types of component, which are incorporated into the output of...

-

The time, \(t\), it takes to pour a certain volume of liquid from a cylindrical container depends on several factors, including the viscosity of the liquid. Assume that for very viscous liquids the...

-

Develop a worksheet simulation for the following problem. The management of Madeira Manufacturing Company is considering the introduction of a new product. The fixed cost to begin the production of...

-

Appendix V Current Job Information Smoke Damage Comm. Water Damage Other Total Total Res. Comm. Res. Comm. Res. Comm. Res. 2,542.00 120,000.00 394.00 270,000.00 Revenue Overhead cost allocated Direct...

-

Zaids financial year ends on 31 October. On 1 November 206 he owed advertising costs of $40. During the year ended 31 October 207 he paid advertising costs of $530. This included $270 for an...

-

Labrador Corporation has total capital gains of $18,000 and total capital losses of $35,000 in 2020. Randy owns 25 percent of Labradors outstanding stock. What is the effect on Labradors and Randys...

-

Newcastle Corporation was incorporated in 2019. For the years 2019 through 2021, Newcastle has the following net capital gain or loss. If Newcastle is in the 21 percent marginal tax bracket for each...

-

Fill in the blank to correctly complete each sentence. The common difference for the sequence -25, -21, -17, -13, . . . is _________.

-

The Sarbanes-Oxley Act a. created the Private Company Accounting Board. b. allows accountants to audit and to perform any type of consulting work for a public company. c. stipulates that violators of...

-

HEB Corporation had net income for 2024 of $60,450. HEB had 15,500 shares of common stock outstanding at the beginning of the year and 20,100 shares of common stock outstanding as of December 31,...

-

Use the following cash payments journal to record the preceding transactions. Date 2024 Ck. No. Account Debited Cash Payments Journal Other Accounts DR Post. Ref. Accounts Payable DR Merchandise...

-

Assume Nile.com began April with 14 units of inventory that cost a total of $266. During April, Nile.com purchased and sold goods as follows: Under the FIFO inventory costing method and the perpetual...

-

Which principle or concept states that businesses should use the same accounting methods and procedures from period to period? a. Disclosure b. Conservatism c. Consistency d. Materiality

-

Give an example of an organism that is parasitic on humans. Give an example of an organism with which humans have a commensal relationship. Finally, give an example of an organism with which we have...

-

How many years will it take a $700 balance to grow into $900 in an account earning 5%?

-

Would it make sense for your school to have a person or group whose main job is to handle customer service problems? Explain your thinking.

-

A firm that produces mixes for cakes, cookies, and other baked items has an incoming toll-free line for customer service calls. The manager of the customer service reps has decided to base about a...

-

Explain how a compensation plan could be developed to provide incentives for experienced salespeople and yet make some provision for trainees who have not yet learned the job.

-

Dollar-Value LIFO On January 1, 2018, Sato Company adopted the dollar-value LIFO method of inventory costing. Sato's ending inventory records appear as follows: Year Current Cost Index 2018 $31,600...

-

How many standards are included in the ELP accreditation standards? What stands out to you about the different areas? What are the topic areas under administration and leadership? What are the...

-

What is performance management systems? Do the companies where you (or others you know) have worked used performance management systems rather than performance appraisal systems? If yes, what kind of...

Study smarter with the SolutionInn App