To examine this issue, imagine that banks can charge any borrower 150 basis points above the interest

Question:

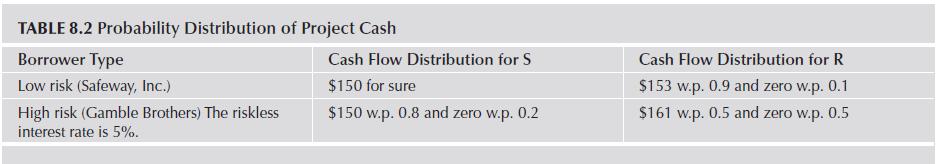

To examine this issue, imagine that banks can charge any borrower 150 basis points above the interest rate at which the bank would break even (in an expected value sense) on that borrower. This is a simple way to recognize the inertia induced by transactions costs or switching costs. That is, the bank can charge a borrower 1.5% above its breakeven rate before the customer will consider switching to another bank. By assumption, the bank’s own borrowing cost is the riskless interest rate. Now suppose the bank has two types of borrowers who are observationally separable. One is a low-risk borrower, Safeway, Inc., and the other is a high-risk borrower, Gamble Brothers. Although the bank can distinguish between these two types, it cannot directly control what the borrower does with the bank loan. Each borrower has the choice of investing in one of two mutually exclusive, single-period projects: S and R, each of which requires a $100 investment. The cash flow probability distributions of these projects are given in Table 8.2 (“w.p.” means “with probability”). Compute the bank’s expected profit on each borrower.

Table 8.2

Step by Step Answer:

Contemporary Financial Intermediation

ISBN: 9780124052086

4th Edition

Authors: Stuart I. Greenbaum, Anjan V. Thakor, Arnoud Boot