Consider two securities that pay risk-free cash flows over the next two years and that have the

Question:

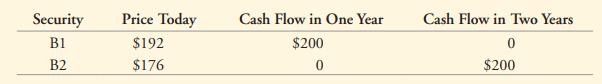

Consider two securities that pay risk-free cash flows over the next two years and that have the current market prices shown here:

a. What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $200 in two years?

b. What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $1600 in two years?

c. Suppose a security with cash flows of $100 in one year and $200 in two years is trading for a price of $260. What arbitrage opportunity is available?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance The Core

ISBN: 9781292158334

4th Global Edition

Authors: Jonathan Berk, Peter DeMarzo

Question Posted: