In addition to footwear, Kenneth Cole Productions designs and sells handbags, apparel, and other accessories. You decide,

Question:

In addition to footwear, Kenneth Cole Productions designs and sells handbags, apparel, and other accessories. You decide, therefore, to consider comparables for KCP outside the footwear industry.

a. Suppose that Fossil, Inc., has an enterprise value to EBITDA multiple of 11.08 and a P/E multiple of 17.09. What share price would you estimate for KCP using each of these multiples, based on the data for KCP in Problems 25 and 26?

b. Suppose that Tommy Hilfiger Corporation has an enterprise value to EBITDA multiple of 7.07 and a P/E multiple of 17.36. What share price would you estimate for KCP using each of these multiples, based on the data for KCP in Problems 25 and 26?

Problem 25

Suppose that in January 2006, Kenneth Cole Productions had EPS of $1.67 and a book value of equity of $12.17 per share.

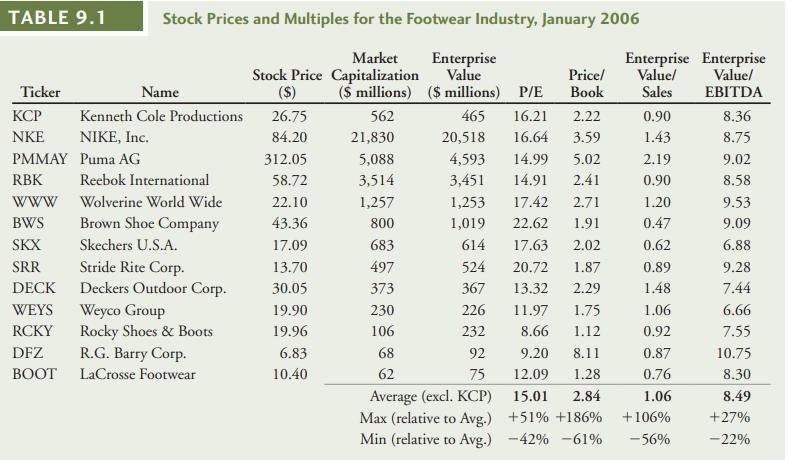

- Using the average P/E multiple in Table 9.1, estimate KCP’s share price.

- What range of share prices do you estimate based on the highest and lowest P/E multiples in Table 9.1?

- Using the average price to book value multiple in Table 9.1, estimate KCP’s share price.

- What range of share prices do you estimate based on the highest and lowest price to book value multiples in Table 9.1?

Problem 26

Suppose that in January 2006, Kenneth Cole Productions had sales of $531 million, EBITDA of $51.3 million, excess cash of $107 million, $3.3 million of debt, and 23 million shares outstanding.

- Using the average enterprise value to sales multiple in Table 9.1, estimate KCP’s share price.

- What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in Table 9.1?

- Using the average enterprise value to EBITDA multiple in Table 9.1, estimate KCP’s share price.

- What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in Table 9.1?

Table 9.1

Step by Step Answer:

Corporate Finance The Core

ISBN: 9781292158334

4th Global Edition

Authors: Jonathan Berk, Peter DeMarzo