Propel Corporation plans to make a $50.2 million investment, initially funded completely with debt. The free cash

Question:

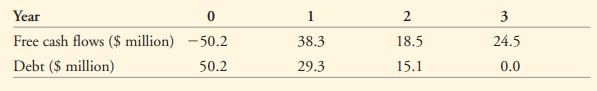

Propel Corporation plans to make a $50.2 million investment, initially funded completely with debt. The free cash flows of the investment and Propel’s incremental debt from the project follow:

Propel’s incremental debt for the project will be paid off according to the predetermined schedule shown. Propel’s debt cost of capital is 7.7%, and its tax rate is 35%. Propel also estimates an unlevered cost of capital for the project of 12.2%.

a. Use the APV method to determine the levered value of the project at each date and its initial NPV.

b. Calculate the WACC for this project at each date. How does the WACC change over time?

Why?

c. Compute the project’s NPV using the WACC method.

d. Compute the equity cost of capital for this project at each date. How does the equity cost of capital change over time? Why?

e. Compute the project’s equity value using the FTE method. How does the initial equity value compare with the NPV calculated in parts (a) and (c)?

Step by Step Answer:

Corporate Finance The Core

ISBN: 9781292158334

4th Global Edition

Authors: Jonathan Berk, Peter DeMarzo