An all-equity firm is considering the following projects: The T-bill rate is 3.5 percent, and the expected

Question:

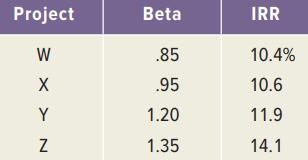

An all-equity firm is considering the following projects:

The T-bill rate is 3.5 percent, and the expected return on the market is 11 percent.

a. Which projects have a higher expected return than the firm’s 11 percent cost of capital?

b. Which projects should be accepted?

c. Which projects would be incorrectly accepted or rejected if the firm’s overall cost of capital was used as a hurdle rate?

Project Beta IRR W .85 10.4% .95 10.6 Y 1.20 11.9 1.35 14.1

Step by Step Answer:

a Projects Y and Z b Using the CAPM to consider the projects we ...View the full answer

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Related Video

The internal rate of return, or IRR, is a metric used to measure the profitability of an investment. It is the discount rate that makes the net present value of an investment equal to zero. To calculate the IRR, we need to know the investment\'s cash flows. These are the inflows and outflows of cash that will result from the investment. For example, an investment in a property might have cash outflows for the purchase price, closing costs, and any renovations, and cash inflows from rent and eventual sale of the property. The IRR is the discount rate at which the NPV of the investment is equal to zero. There are many ways to calculate IRR, from simple spreadsheet functions to more complex financial modeling software. It\'s worth noting that IRR can be a bit tricky when it comes to projects that don\'t have a consistent cash flow over time. These types of investments are known as \"irregular cash flow\" and the IRR might be misleading or not suitable to calculate. There are other metrics to evaluate these investments such as Modified Internal Rate of Return (MIRR) which is a variation of IRR and is used to get more accurate results.

Students also viewed these Business questions

-

A manufacturing firm is considering the following mutually exclusive alternatives: Determine which project is a better choice at MARR = 15% on the basis of the IRR criterion. Net Cash Flow Project B...

-

SML and WACC an all equity firm is considering the following projects: The T-bill rate is 5 percent, and the expected return on the market is 12 percent. a. Which projects have a higher expected...

-

Alison is an interior designer with her own business. She does not have an office as she thinks it would just be a waste of money as her clients do not come to her, but she goes to the clients. It is...

-

A ball of mass 0.440 kg moving east( + x direction) with a speed of 3.30m/s collides head-on with a 0.220-kg ball at rest. If the collision is perfectly elastic, what will be the speed and direction...

-

Pollsters regularly conduct opinion polls to determine the popularity rating of the current president. Suppose a poll is to be conducted tomorrow in which 2,000 individuals will be asked whether the...

-

Using the information provided in QS 1-15, calculate each of the following financial statement elements. 1. Total revenues 5. Total liabilities 2. Total operating expenses 6. Tim Roadster, capital...

-

An example of a response from Amazon when this textbook you are reading was chosen online follows. It indicates that some people who purchased this text also tended to purchase The World Is Flat,...

-

J. J. Technology Company, which operates a chain of 30 electronics supply stores, has just completed its fourth year of operations. The direct write-off method of recording bad debt expense has been...

-

Defines the following concepts: a. Regular education b. Special education c. Individualized Educational Program (PEI) d. Individualized Transition Plan (PIT) e, Individualized Pre-employment Plan...

-

On June 1, Maui Travel Agency, Inc., was established. The following transactions were completed during the month. 1. Stockholders invested $40,000 cash, receiving common stock in exchange. 2. Paid...

-

Suppose your company needs $45 million to build a new assembly line. Your target debt-equity ratio is .45. The flotation cost for new equity is 7 percent, but the flotation cost for debt is only 3...

-

Brodsky Metals Corporation has 8.1 million shares of common stock outstanding and 150,000 5.8 percent semiannual bonds outstanding, par value $1,000 each. The common stock currently sells for $41 per...

-

Discuss the concept of equivalent units and how that concept relates to management decision making. Be sure to include information in your discussion about the weighted-average method in comparison...

-

Which of the following types of technological change in health care are likely to be cost increasing: (a) threats of malpractice suits that cause physicians to order more diagnostic tests on average...

-

After a large increase in membership, HMO enrollments fl attened in the late 1980s and many HMOs suffered fi nancial diffi culties. How could this be explained according to what is known about the...

-

Discuss the difference between cardinal and ordinal utility. Why is cardinal utility necessary for the analysis of risk and insurance?

-

A J. Wright, a sole trader, extracted the following trial balance from his books at the close of business on 31 March 2012: Notes: (a) Inventory 31 March 2012 6,805. (b) Wages and salaries accrued at...

-

What is the medical arms race (MAR) hypothesis? What features of hospital markets make the presence of an unproductive MAR possible?

-

Pam Corporation owns a 40 percent interest in the outstanding common stock of Sun Corporation, having acquired its interest for $2,400,000 on January 1, 2016, when Sun's stockholders' equity was...

-

(a) Given a mean free path = 0.4 nm and a mean speed vav = 1.17 105 m/s for the current flow in copper at a temperature of 300 K, calculate the classical value for the resistivity of copper. (b)...

-

Fhloston Manufacturing uses 1,860 switch assemblies per week and then reorders another 1,860. If the relevant carrying cost per switch assembly is $6.25, and the fixed order cost is $730, is the...

-

The Trektronics store begins each week with 675 phasers in stock. This stock is depleted each week and reordered. If the carrying cost per phaser is $73 per year and the fixed order cost is $340,...

-

The Harrington Corporation is considering a change in its cash-only policy. The new terms would be net one period. Based on the following information, determine if Harrington should proceed or not....

-

In the context of solid-liquid extraction, how do particle size distribution, porosity, and surface area of the solid matrix impact extraction kinetics and overall efficiency? Provide examples of...

-

Discuss the challenges and opportunities associated with the extraction of bioactive compounds from natural sources using environmentally benign solvents and green extraction techniques, such as...

-

The driver of a car traveling at 31.9 m/s applies the brakes and undergoes a constant deceleration of 1.12 m/s 2 . How many revolutions does each tire make before the car comes to a stop, assuming...

Study smarter with the SolutionInn App