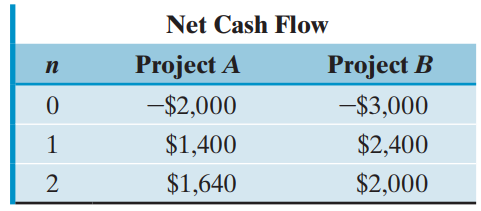

A manufacturing firm is considering the following mutually exclusive alternatives: Determine which project is a better choice

Question:

Determine which project is a better choice at MARR = 15% on the basis of the IRR criterion.

MARRMinimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Net Cash Flow Project B -$3,000 Project A -$2,000 п $1,400 $2,400 $1,640 $2,000

Step by Step Answer:

Determine the cash flow on increme...View the full answer

Related Video

The internal rate of return, or IRR, is a metric used to measure the profitability of an investment. It is the discount rate that makes the net present value of an investment equal to zero. To calculate the IRR, we need to know the investment\'s cash flows. These are the inflows and outflows of cash that will result from the investment. For example, an investment in a property might have cash outflows for the purchase price, closing costs, and any renovations, and cash inflows from rent and eventual sale of the property. The IRR is the discount rate at which the NPV of the investment is equal to zero. There are many ways to calculate IRR, from simple spreadsheet functions to more complex financial modeling software. It\'s worth noting that IRR can be a bit tricky when it comes to projects that don\'t have a consistent cash flow over time. These types of investments are known as \"irregular cash flow\" and the IRR might be misleading or not suitable to calculate. There are other metrics to evaluate these investments such as Modified Internal Rate of Return (MIRR) which is a variation of IRR and is used to get more accurate results.

Students also viewed these Business questions

-

A manufacturing firm is considering replacing one of its CNC machines with a machine that is newer and more efficient. The company has an MARR of 12%. Old Machine: The firm purchased the current CNC...

-

An all-equity firm is considering the following projects: The T-bill rate is 5 percent, and the expected return on the market is 13 percent. (a) Which projects have a higher expected return than the...

-

An all-equity firm is considering the following projects: The T-bill rate is 4 percent, and the expected return on the market is 11 percent. a. Which projects have a higher expected return than the...

-

Plastic Co Pte Ltd (Plastico) is a Fiji company. The company has issued and paid up capital of $250,000 held in equal parts by two brothers. The companys business involves making plastic products for...

-

A passenger on a stopped bus notices that rain is falling vertically just outside the window. When the bus moves with constant velocity, the passenger observes that the falling raindrops are now...

-

Use a working paper to consolidate the trial balances of ITI and GOC at June 30, 2018. Calculate the DR. CR. Eliminations. International Technology Inc. (ITI) acquired all of the voting stock of...

-

Gavin Jones believes that for a derivative security with price \(P(S)\). the values of \(\triangle, \Gamma\), and \(\Theta\) are related. Show that in fact +SA+ = rP.

-

a. Segar Company budgets sales of $3,200,000, fixed costs of $700,000, and variable costs of $2,240,000. What is the contribution margin ratio for Segar Company? b. If the contribution margin ratio...

-

The directors of a company require that all investment projects should be evaluated using either payback period or return on capital employed ( accounting rate of return ) . The target payback period...

-

Which of the following data units is decapsulated from a user datagram? a. A datagram b. A segment c. A message

-

Consider the following two mutually exclusive alternatives: (a) Determine the IRR on the incremental investment in the amount of $2,000. (b) If the firms MARR is 10%, which alternative is the better...

-

Consider the following two mutually exclusive investment projects: Determine the range of MARR where Project 2 would be preferred over Project 1 with do-nothing alternative. (a) MARR ¤ 11.80%...

-

What mass of steam at 100oC must be added to 1.00 kg of ice at 0oC to yield liquid water at 20oC?

-

10x1/3x/. The market 2. (25 pts) Assume that the company production function is given by y = 10x1x2 price (p) for output y is $30. The company uses only two inputs to produce y, input x has a market...

-

Use the following information to answer the question below: 1 2 3 25 42 57 6 88 7 8 96 103 9 10 11 12 109 114 118 121 The average product (rounded to 2 decimal places) of the 8th hour of study is:...

-

Resistance to change is a normal everyday aspect in the workplace. Note what happens to the organizational climate when this resistance occurs and any tactics to reduce negative connotations when...

-

Explain why people are resistant to change? and 2. What are some considerations or methods to reduce this resistance?

-

Refer to the data in the table and use Okun's law to determine the size of GDP gap in percentage-point terms as well as how much output is being forgone. Potential Real GDP 200 500 400 380 Natural...

-

Let (a) Compute A 2 , A 3 , . . . , A 7 . (b) What is A 2001 ? Why? A = -1

-

Answer the following two independent questions. a. MM Corporation is considering several proposed investments for the coming budget year. MM produces electrical apparatus for industrial complexes....

-

Choose one of the common decision-making biases that you have either personally experienced or which you are guilty of and describe the following: (1) what error was involved, (2) what were the...

-

Ask the class members to think of places they have worked or organizations they have been associated with. They should identify decisions that they observed being made by people within the...

-

Which ethical viewpoint do you think is the best? Describe the viewpoint and explain your choice.

-

Suppose the North Carolina University system tests the idea that computerization of statistics classes increases student performance in the courses. If the computers are found to have a beneficial...

-

M. Handy is a self-employed painter who earned $32,400 last year. Her FICA tax rate is 15.3% of her earnings. How much FICA tax did she pay?

-

Using the same iThe Shouldice Hospital specializes in hernia operations. They have a special procedure that not only has a much higher rate of long-term success than other hospitals, but also allows...

Study smarter with the SolutionInn App