Consider the following cash flows of two mutually exclusive projects for A-Z Motorcars. Assume the discount rate

Question:

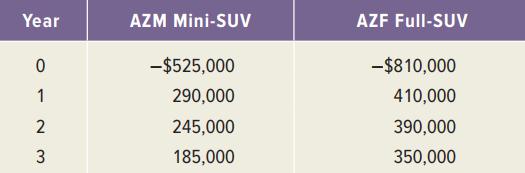

Consider the following cash flows of two mutually exclusive projects for A-Z Motorcars. Assume the discount rate for both projects is 10 percent.

a. Based on the payback period, which project should be taken?

b. Based on the NPV, which project should be taken?

c. Based on the IRR, which project should be taken?

d. Based on the above analysis, is incremental IRR analysis necessary? If yes, please conduct the analysis.

Year AZM Mini-SUV AZF Full-SUV -$525,000 -$810,000 1 290,000 410,000 2 245,000 390,000 3 185,000 350,000

Step by Step Answer:

a The payback period is the time that it takes for the cumulative undiscounted cash inflows to equal the initial investment AZM MiniSUV Cumulative cas...View the full answer

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Related Video

The internal rate of return, or IRR, is a metric used to measure the profitability of an investment. It is the discount rate that makes the net present value of an investment equal to zero. To calculate the IRR, we need to know the investment\'s cash flows. These are the inflows and outflows of cash that will result from the investment. For example, an investment in a property might have cash outflows for the purchase price, closing costs, and any renovations, and cash inflows from rent and eventual sale of the property. The IRR is the discount rate at which the NPV of the investment is equal to zero. There are many ways to calculate IRR, from simple spreadsheet functions to more complex financial modeling software. It\'s worth noting that IRR can be a bit tricky when it comes to projects that don\'t have a consistent cash flow over time. These types of investments are known as \"irregular cash flow\" and the IRR might be misleading or not suitable to calculate. There are other metrics to evaluate these investments such as Modified Internal Rate of Return (MIRR) which is a variation of IRR and is used to get more accurate results.

Students also viewed these Business questions

-

Consider the following cash flows of two mutually exclusive projects for AZ-Motorcars. Assume the discount rate for AZ- Motorcars is 10 percent. a. Based on the payback period, which project should...

-

Consider the following cash flows of two mutually exclusive projects for Spartan Rubber Company. Assume the discount rate for Spartan Rubber Company is 10 percent. a. Based on the payback period,...

-

Consider the following cash flows of two mutually exclusive projects for Spartan Rubber Company. Assume the discount rate for both projects is 10 percent. a. Based on the payback period, which...

-

Consider the modules diagram in question 17. Suppose we want the code in module com.sf to depend on code in module com.ny. Which of the following directives goes into module com.nys module-info file...

-

Suppose the events B1 and B2 are mutually exclusive and complementary events, such that P(B1) = .75 and P(B2) = .25. Consider another event A such that P(A|B1) = .3 and P(A|B2) = .5. a. Find P(B1 ...

-

A simply supported wood beam is subjected to point load P at mid-span. The stresses on element C are known to be x = 92 psi and xy = 7 psi. Find the principal stresses on the element and show them...

-

Describe the various court rulings involving PPACA.

-

Calculating EAC A five-year project has an initial fixed asset investment of $240,000, an initial NWC investment of $20000, and an annual OCF of $32,000. The fixed asset is fully depreciated over the...

-

9. If f(x)=In x, then lim f(x)-(3) is 813 413

-

You have an opportunity to purchase a 5-story multifamily building which is presently vacant. The asking price is $500,000. After discussing the project with your architect and general contractor,...

-

Mario Brothers, a game manufacturer, has a new idea for an adventure game. It can market the game either as a traditional board game or as a PC game, but not both. Consider the following cash flows...

-

The treasurer of Tropical Fruits, Inc., has projected the cash flows of Projects A, B, and C as follows: Suppose the relevant discount rate is 12 percent per year. a. Compute the profitability index...

-

For the frame shown in Figure P16.7, write the stiffness matrix in terms of the three degrees of freedom indicated. Use both the method of introducing unit displacements and the member stiffness...

-

Provide your opinion regarding the following: 1. Because a hotel keeper has a higher degree of liability to guests if there has been criminal activity on the hotel's premises or even in the area of...

-

Initial Response Identify five possible topics that you would like to explore for your persuasive speech using the enumerated list below that will help you identify your experiences and expertise...

-

"It is probably better to have mediocre technical skills and excellent international business communication skills than to have excellent technical skills and poor international business...

-

How business communication differs from informal or personal communication(2)consideration for intercultural communication in business environment(3)how ethics applies to business communication,?

-

How does payroll withholding help a company's employees? 2. List at least three types of tax that a company may have to withhold from employees paychecks.3. What are the two main types of tax forms a...

-

In a contract drawn up by Booke Company, it agreed to sell and Yermack Contracting Company agreed to buy wood shingles at $950 per bunch. After the shingles were delivered and used, Booke Company...

-

(a) What is the focal length of a magnifying glass that gives an angular magnification of 8.0 when the image is at infinity? (b) How far must the object be from the lens?

-

In an ideal economy, net working capital is always zero. Why might net working capital be positive in a real economy?

-

Wildcat, Inc., has estimated sales (in millions) for the next four quarters as follows: Sales for the first quarter of the year after this one are projected at $120 million. Accounts receivable at...

-

Rework Problem 13 assuming the following: In Problem 13, Wildcat, Inc., has estimated sales (in millions) for the next four quarters as follows: Sales for the first quarter of the year after this one...

-

A project costs $80 MM, with 25% of the investment int in year 1 and the balance in year 2. The plant operates atates at 50% capacity in year 3 and then full capacity for the next next 20 years. The...

-

What is organizational Behaviour the study of? How is social sciences related to organizational behavior? What is the difference between social science and organizational behavior? What is the...

-

Describe the nature of organization change, including forces for change and planned versus reactive change

Study smarter with the SolutionInn App