Mario Brothers, a game manufacturer, has a new idea for an adventure game. It can market the

Question:

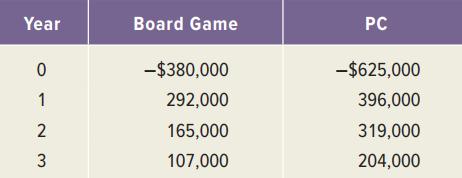

Mario Brothers, a game manufacturer, has a new idea for an adventure game. It can market the game either as a traditional board game or as a PC game, but not both. Consider the following cash flows of the two mutually exclusive projects. Assume the discount rate for both projects is 10 percent.

a. Based on the payback period rule, which project should be chosen?

b. Based on the NPV, which project should be chosen?

c. Based on the IRR, which project should be chosen?

d. Based on the incremental IRR, which project should be chosen?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Question Posted: