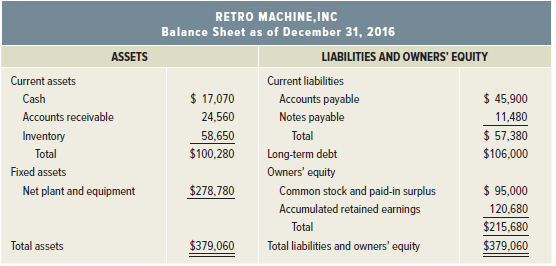

The most recent financial statements for Retro Machine, Inc., follow. Sales for 2017 are projected to grow

Question:

RETRO MACHINE INC

2016 Income Statement

Sales......................................................................$594,600

Costs........................................................................462,700

Other expenses........................................................12,200

Earnings before interest and taxes....................$119,700

Interest paid................................................................8,960

Taxable income.....................................................$110,740

Taxes (35%).................................................................38,759

Net income...............................................................$ 71,981

Dividends..................................................................$ 28,792

Addition to retained earning.....................................43,189

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Corporate Finance Core Principles and Applications

ISBN: 978-1259289903

5th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan