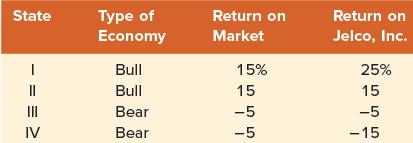

Consider the following possible returns both on the stock of Jelco, Inc., and on the market: Though

Question:

Consider the following possible returns both on the stock of Jelco, Inc., and on the market:

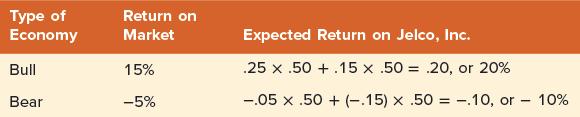

Though the return on the market has only two possible outcomes (15% and −5%), the return on Jelco has four possible outcomes. It is helpful to consider the expected return on a security for a given return on the market. Assuming each state is equally likely, we have:

Jelco, Inc., responds to market movements because its expected return is greater in bullish states than in bearish states. We now calculate exactly how responsive the security is to market movements. The market’s return in a bullish economy is 20 percent [ = 15 % − ( −5% ) ] greater than the market’s return in a bearish economy. However, the expected return on Jelco in a bullish economy is 30 percent [= 20% − (−10%)] greater than its expected return in a bearish state.

Thus, Jelco, Inc., has a responsiveness coefficient of 1.5 (= 30%/20%).

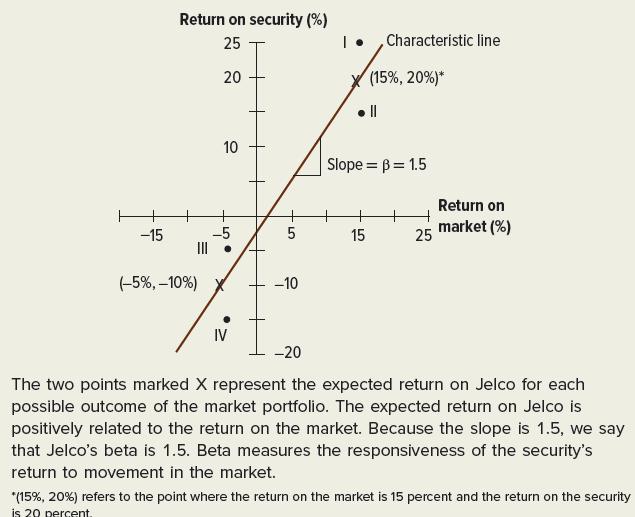

This relationship appears in Figure 11.10. The returns for both Jelco and the market in each state are plotted as four points. In addition, we plot the expected return on the security for each of the two possible returns on the market. These two points, each of which we designate by an X, are joined by a line called the characteristic line of the security. The slope of the line is 1.5, the number calculated in the previous paragraph. This responsiveness coefficient of 1.5 is the beta of Jelco. Figure 11.10 Performance of Jelco, Inc., and the Market Portfolio

Figure 11.10

The interpretation of beta from Figure 11.10 is intuitive. The graph tells us that the returns of Jelco are magnified 1.5 times over those of the market. When the market does well, Jelco’s stock is expected to do even better. When the market does poorly, Jelco’s stock is expected to do even worse. Now imagine an individual with a portfolio near that of the market who is considering the addition of Jelco to her portfolio. Because of Jelco’s magnification factor of 1.5, she will view this stock as contributing much to the risk of the portfolio. (We will show shortly that the beta of the average security in the market is 1.) Jelco contributes more to the risk of a large, diversified portfolio than does an average security because Jelco is more responsive to movements in the market.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe