Rosenior plc has been investing surplus funds in a small portfolio of shares over the past few

Question:

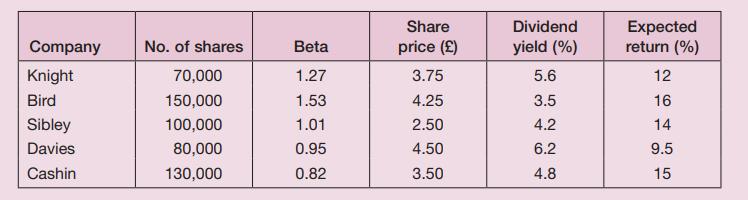

Rosenior plc has been investing surplus funds in a small portfolio of shares over the past few years. Details of the portfolio are as follows:

The current market return is 12 per cent and the yield on Treasury bills is 5 per cent.

(a) Is Ronsenior’s portfolio more or less risky than that of the market portfolio? Support your answer with appropriate calculations.

(b) Give Ronsenior plc advice on how it should change the composition of its portfolio, giving a rationale for the changes that you recommend.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance Principles And Practice

ISBN: 9781292450940

9th Edition

Authors: Denzil Watson, Antony Head

Question Posted: