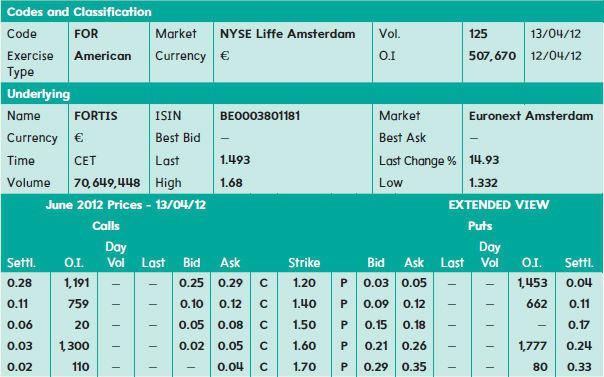

Use the option quote information on Ageas from Euronext Liffe shown here to answer the questions that

Question:

Use the option quote information on Ageas from Euronext Liffe shown here to answer the questions that follow.

(a) Suppose you buy 20 contracts of the June €1.50 call option. How much will you pay, ignoring commissions?

(b) In part (a), suppose that Ageas equity is selling for €1.70 per share on the expiration date. How much is your options investment worth? What if the terminal share price is €1.35? Explain.

(c) Suppose you buy 10 contracts of the June €1.20 put option. What is your maximum gain?

On the expiration date, Ageas is selling for €1.14 per share. How much is your options investment worth? What is your net gain?

(d) In part (c), suppose you sell 10 of the June €1.20 put contracts. What is your net gain or loss if Ageas is selling for €1.14 at expiration? For €1.32? What is the break-even price – that is, the terminal share price that results in a zero profit?

Step by Step Answer:

Corporate Finance

ISBN: 9780077173630

3rd Edition

Authors: David Hillier, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Jeffrey F. Jaffe