The Walliston Group (WG) provides tax advice to multinational firms. WG charges clients for (a) direct professional

Question:

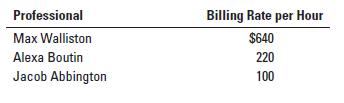

The Walliston Group (WG) provides tax advice to multinational firms. WG charges clients for (a) direct professional time (at an hourly rate) and (b) support services (at 30% of the direct professional costs billed). The three professionals in WG and their rates per professional hour are as follows:

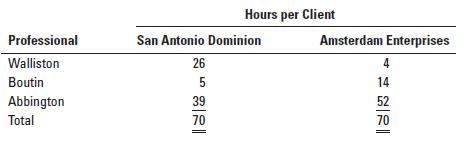

WG has just prepared the May 2014 bills for two clients. The hours of professional time spent on each client are as follows:

Required:

1. What amounts did WG bill to San Antonio Dominion and Amsterdam Enterprises for May 2014?

2. Suppose support services were billed at $75 per professional labor-hour (instead of 30% of professional labor costs). How would this change affect the amounts WG billed to the two clients for May 2014? Comment on the differences between the amounts billed in requirements 1 and 2.

3. How would you determine whether professional labor costs or professional labor-hours is the more appropriate allocation base for WG’s support services?

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0133428704

15th edition

Authors: Charles T. Horngren, Srikant M. Datar, Madhav V. Rajan