Question: Physical Quantities Method: Questions (a) and (b) are based on Vreeland, Inc., which manufactures products X. Y, and Z from a joint process. Joint product

Physical Quantities Method: Questions

(a) and

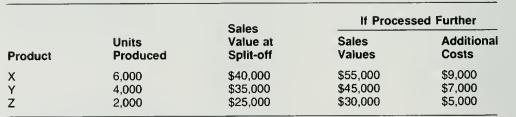

(b) are based on Vreeland, Inc., which manufactures products X. Y, and Z from a joint process. Joint product costs were $60,000. Additional information is provided below.

a. Assuming that joint product costs are allocated using the physical quantities (units produced) method, what were the total costs of product X (including $9,000 if processed further)?

(1) $27,000. (2) $29,000. (3) $33,000. (4) $39,000.

b. Assuming that joint product costs are allocated using the net realizable value method, what were the total costs of product Y (including the $7,000 if processed further)?

(1) $27,000. (2) $28,000. (3) $28,350. (4) $32,200.

Sales Units Value at Sales If Processed Further Additional Product Produced Split-off Values Costs XN 6,000 $40,000 $55,000 $9,000 Y 4,000 $35,000 $45,000 $7,000 2,000 $25,000 $30,000 $5,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts