Refer to the information in Problem 20-51 for the Davidson Yachts Company. Required 1. What is the

Question:

Required

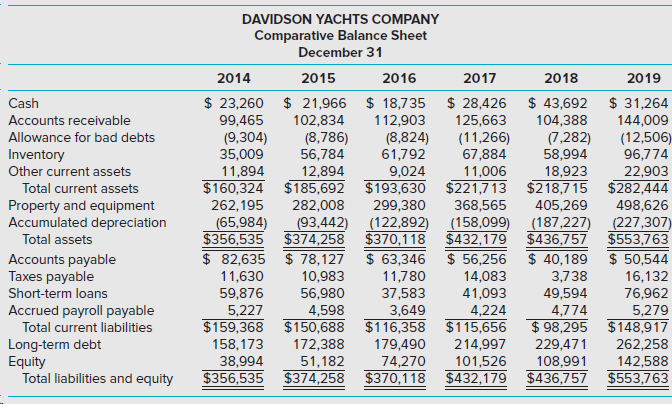

1. What is the valuation of Davidson Yachts Company using the book value of equity method?

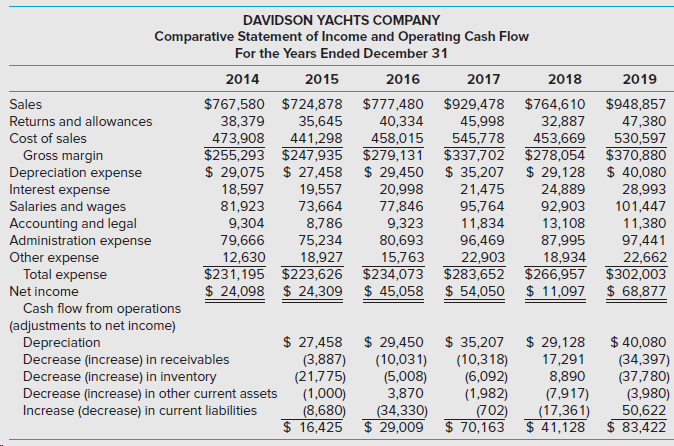

2. What is the valuation of Davidson Yachts Company using the multiples-based method on earnings? Assume the industry average earnings multiple is 7. Use the median value of the most recent 3 years for earnings.

3. What is the valuation of Davidson Yachts Company using the mulitples-based method on operating cash flow? Assume the industry average multiple on operating cash flow is 5. Use the median value of the most recent 3 years for cash flow.

4. Compare and discuss the three valuations. Which of the methods would you use? Why?

DAVIDSON YACHTS COMPANY Comparative Balance Sheet December 31 2017 2014 2015 2016 2018 2019 $ 23,260 $ 21,966 $ 18,735 $ 28,426 $ 43,692 $ 31,264 Cash Accounts receivable 99,465 102,834 112,903 125,663 104,388 144,009 (12,506) 96,774 (8,786) 56,784 12,894 $160,324 $185,692 $193,630 Allowance for bad debts (9,304) 35,009 11,894 (8,824) 61,792 9,024 (11,266) 67,884 11,006 $221,713 (7,282) 58,994 Inventory Other current assets 18,923 22,903 $282,444 $218,7 15 405,269 Total current assets Property and equipment Accumulated depreciation 262,195 282,008 299,380 368,565 498,626 (227,307) $553,763 $ 50,544 16,132 (65,984) $356,535 $ 82,635 11,630 59,876 5,227 $159,368 $150,688 $116,358 (93,442) (122,892) $374,258 $370,118 $ 78,127 (158,099) $432,179 $ 56,256 (187,227) $436,757 $ 40,189 Total assets $ 63,346 11,780 Accounts payable Taxes payable 10,983 14,083 3,738 37,583 3,649 49,594 Short-term loans 56,980 41,093 76,962 Accrued payroll payable 5,279 $148,917 4,598 4,224 4,774 $115,656 $ 98,295 Total current liabilities 172,388 Long-term debt Equity Total liabilities and equity 158,173 179,490 214,997 229,471 262,258 38,994 $356,535 74,270 $370,118 51,182 101,526 108,991 $436,757 142,588 $374,258 $432,179 $553,763 DAVIDSON YACHTS COMPANY Comparative Statement of Income and Operating Cash Flow For the Years Ended December 31 2014 2015 2016 2017 2018 2019 $767,580 $724,878 35,645 $777,480 $929,478 $764,610 $948,857 47,380 530,597 $370,880 $ 40,080 Sales Returns and allowances 38,379 40,334 45,998 32,887 473,908 $255,293 $247,935 $ 29,075 $ 27,458 18,597 Cost of sales 441,298 458,015 $279,131 $337,702 $ 29,450 545,778 Gross margin Depreciation expense Interest expense Salaries and wages Accounting and legal Administration expense 453,669 $278,054 $ 29,128 24,889 92,903 $ 35,207 19,557 20,998 21,475 28,993 81,923 73,664 77,846 95,764 101,447 9,304 79,666 12,630 $231,195 $223,626 $ 24,098 $ 24,309 8,786 9,323 80,693 15,763 $234,073 $283,652 $266,957 $ 45,058 11,380 11,834 96,469 13,108 87,995 75,234 97,441 Other expense Total expense 18,927 22,903 18,934 22,662 $302,003 $ 68,877 Net income $ 54,050 $ 11,097 Cash flow from operations (adjustments to net income) Depreciation Decrease (increase) in receivables Decrease (increase) in inventory Decrease (increase) in other current assets Increase (decrease) in current liabilities $ 27,458 (3,887) (21,775) (1,000) (8,680) $ 16,425 $ 29,450 (10,031) (5,008) 3,870 $ 35,207 (10,318) (6,092) (1,982) (702) $ 70,163 $ 29,128 17,291 8,890 (7,917) (17,361) $ 41,128 $ 40,080 (34,397) (37,780) (3,980) 50,622 $ 83,422 (34,330) $ 29,009

Step by Step Answer:

1 Using most recent figures the book value for DavidsonYachts equity is 142588 taken from the balan...View the full answer

Cost Management A Strategic Emphasis

ISBN: 9781259917028

8th Edition

Authors: Edward Blocher, David F. Stout, Paul Juras, Steven Smith

Students also viewed these Business questions

-

Refer to the information in problem 20. Determine George and Mary's income tax liability for 2013. How much tax do they save by itemizing their deductions rather than taking the standard deduction?...

-

Refer to the information in Problem 20-5B. Assume that Oakley International uses the FIFO method to account for its process costing system. The following additional information is available. ...

-

Refer to the information in problem 20-44 for the Blue Water Yachts Company. In problem 20-44, Blue Water Yachts is a small company founded by two businesspeople who are friends and avid sailors. At...

-

A company has the following results for the three accounting periods to 31 March 2021: Assuming that all possible claims are made to relieve the trading loss against total profits, calculate the...

-

Use the information in BE4-17 to prepare a statement of retained earnings for Global Corporation, assuming that in 2017, Global discovered that it had overstated 2014 depreciation by $40,000 (net of...

-

A brick is tied to a balloon filled with air and then tossed into the ocean. As the balloon is pulled downward by the brick, the buoyant force on it decreases. Why?

-

Design a heat exchanger network for MER with at most 15 heat exchangers (including utility heaters) and \(\Delta T_{\text {min }}=10^{\circ} \mathrm{C}\) for the following streams: When MER targets...

-

a. Identify the equilibrium outcome(s) in each of the three payoff tables. b. In each table, predict the exact outcome that will occur and explain your reasoning. c. In Table III, suppose the column...

-

Tanner-UNF Corporation acquired as an investment $240 million of 5% bonds, dated July 1, on July 1, 2024. Company management is holding the bands in its trading portfolio The market interest rate...

-

The random variable x represents the depth of rainfall in June, July, and August in Houston. The whole PDF is symmetric and is shaped as an isosceles triangle, with base 060 in. Between values of and...

-

Davidson Yachts is a small company founded by two businesspeople who are friends and avid sailors. At present, they are interested in expanding the business and have asked you to review its financial...

-

Brooks Plumbing Products Inc. (BPP) manufactures plumbing fixtures and other home improvement products that are sold in Home Depot and Walmart as well as hardware stores. BPP has a solid reputation...

-

How can a firm such as Lloyds try and overcome any clashes between the requirements of staff, the business and customers?

-

The notation lim f(x) is read x-4

-

Simplify the following Boolean functions algebraically. Indicate which of the Laws are applied at each step. Check your answer with truth tables for Problems 6. ABC+AB+ABC

-

Detailed Company Profile and Product Information - Choose a company/product that you are genuinely interested in. It makes the whole assignment interesting. Iphone-Playstation-Coffee- Vacation -...

-

K Subtract as indicated. 5x - 12 x-4 x-2 X-2

-

Where does the 5 year come from? Net Flotation Costs Flotation costs = $ 4.8m PV of future tax savings = (4.8m/5yrs) 0.4PVIFA (5yrs, 5.4%) =0.96m 0.44.282020 =$ 1,644,296 (2 points) Net Flotation...

-

In Example 5 we saw that y = Φ1 (x) = (25 x 2 ) and y = 2 (x) = -(25 x 2 ) are solutions of dy/dx = -x/y on the interval (-5, 5). Explain why the peicewise-defined function IV25 - , 5

-

In Exercises, find the equation of the tangent line at the given point on each curve. 2y 2 - x = 4; (16, 2)

-

Review the list of factors that affect PD service levels in Exhibit 11-3. Indicate which ones are most likely to be improved by EDI links between a supplier and its customers.

-

Explain the total cost approach and why it may cause conflicts in some firms. Give examples of how conflicts might occur between different departments.

-

Discuss why economies of scale in transportation might encourage a producer to include a regional merchant wholesaler in the channel of distribution for its consumer product.

-

What are the main ethical issues that researchers may encounter when conducting business research and how can they address these issues ?

-

How has womens participation in the Olympics changed over the years? Explain

-

What is the Christian view of work according to the God is Not One: The Eight Rival Religions That Run the World.

Study smarter with the SolutionInn App