Question: EcoClean plans to introduce an environmentally friendly and pet-safe all-purpose cleaning solution. Because the chemical nature of the product is innovative, the product development and

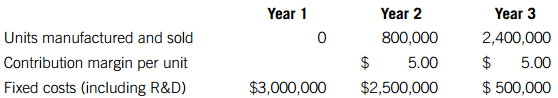

EcoClean plans to introduce an environmentally friendly and pet-safe all-purpose cleaning solution. Because the chemical nature of the product is innovative, the product development and design phase will be extensive. The accountants have estimated three years of information for the product as follows:

After the first three years, production and sales are expected to maintain a consistent level that meets EcoClean return on investment requirements. No end-of-life costs are predicted. EcoClean has income from other products to offset any initial losses from the new product; however, the project has a required rate of return of 8%.

Required:

A. Determine the net present value (NPV) of the cash flows of the project over its estimated first three years of its life cycle. Ignore the effects of inflation.

B. Would you recommend that EcoClean undertake the project? Explain.

Year 1 Year 2 Year 3 Units manufactured and sold Contribution margin per unit Fixed costs (including R&D) 800,000 5.00 2,400,000 5.00 $3,000,000 $2,500,000 $ 500,000

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

A Year Contribution Margin Fixed Costs Net Cash Flows Net Pre... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1601_606321ef08ff4_688821.pdf

180 KBs PDF File

1601_606321ef08ff4_688821.docx

120 KBs Word File