Halton Inc. manufactures kitchen cabinets to customer order. Halton uses a normal job-costing system to allocate manufacturing

Question:

The record also showed that manufacturing overhead was over-applied by $9,000 to the work-in-process account.

REQUIRED

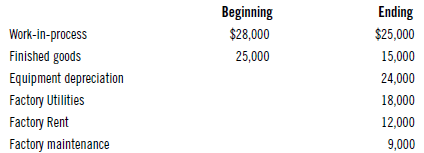

A. What is the manufacturing overhead amount applied to the work-in-process account?

B. What is the manufacturing overhead rate per direct hour?

C. What are the manufacturing costs, using normal job costing, for last month? What was the cost of goods manufactured? What is the cost of goods sold?

D. Prorate the amount of over-applied manufacturing overhead based on the ending balance of work-in-process, finished goods, and cost of goods sold. Prepare the adjusting journal entry. What are the balances in the work in process, finished goods, and cost of goods sold accounts after the adjustment?

E. The ending balance of the work-in-process account consists of two incomplete jobs €“ Job 207 and Job 214. Job 207 was charged $2,500 and Job 214, $3,750 of direct materials. Job 207 and Job 214 were charged 150 and 225 direct labour hours and manufacturing overhead. Present the job costs for each incomplete job.

Step by Step Answer:

Cost Management Measuring, Monitoring and Motivating Performance

ISBN: 978-1119185697

3rd Canadian edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott, Liang Hsuan Chen, Gail Cook