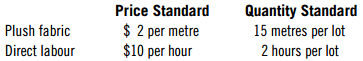

Plush pet toys are produced in a largely automated factory in standard lots of 100 toys each.

Question:

Variable overhead, estimated at $5 per lot, consists of miscellaneous items such as thread, a variety of plastic squeakers, and paints that are applied to create features such as eyes and whiskers. Fixed overhead, estimated at $24,000 per month, consists largely of depreciation on the automated machinery and rent for the building. Variable overhead is allocated based on lots produced. The standard fixed overhead allocation rate is based on the estimated output of 1,000 lots per month.

Actual data for last month follow:

Production..............................................................2,400 lots

Sales.......................................................................1,600 lots

Plush fabric purchased.........................................30,000 metres

Cost of fabric purchased....................................$62,000

Fabric used...........................................................34,000 metres

Direct labour..........................................................4,200 hours

Direct labour cost...............................................$39,000

Variable overhead..............................................$12,000

Fixed overhead...................................................$24,920

The company€™s policy is to record materials price variances at the time materials are purchased.

Required:

A. Compute the commonly used direct cost and overhead variances.

B. Management is considering further automation in the factory. Robotized forklifts could reduce the standard direct labour per lot to 1.5 hours.

1. Estimate the savings per lot that would be realized from this additional automation.

2. Assume that the company would be able to generate the savings as calculated. Considering only quantitative factors, calculate the maximum price the managers would be willing to pay for the robotized forklifts. Assume that the company€™s management requires equipment costs to be recovered in five years, ignoring the time value of money.

Step by Step Answer:

Cost Management Measuring, Monitoring and Motivating Performance

ISBN: 978-1119185697

3rd Canadian edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott, Liang Hsuan Chen, Gail Cook