Refer to the information from Problem 10.49, Parts 1, 2, and 3. The budget indicates that the

Question:

Required:

A. Identify the assumptions that are relevant for sensitivity analysis. Relevant assumptions are assumptions that the manager could potentially influence by changing the company€™s operating plans.

B. Identify possible changes in budget assumptions that might eliminate the forecasted loss (i.e., that would lead to a breakeven).

C. Perform sensitivity analysis, using the input section of your spreadsheet to determine a set of assumption changes that would cause budgeted income to break even. Explain your choices.

D. Describe uncertainties and their effects on the assumptions you made in Part A.

Data from Prob. 10.49:

Walker Products fell behind in paying its vendors, and it now has a poor credit rating. Consequently, all suppliers demand cash on delivery (even employees are paid on a daily basis). The firm has a note payable on which principal payments have been suspended.

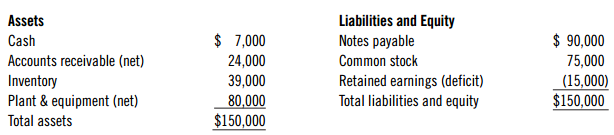

The firm must pay interest on this note at the rate of 1.5% of the beginning balance. If Walker misses even one interest payment, the bank will initiate bankruptcy proceedings. The following is Walker€™s balance sheet as of October 1.

Walker sells its product for $25 per unit. The purchase cost is $15 per unit. Budgeted sales for October are 2,500 units, and ending budgeted inventory is 2,000 units. Typically, 60% of Walker€™s customers pay in the month of sale, 35% in the month following purchase, and 5% never pay.Walker€™s employees are paid strictly on commission, based on 10% of sales. The firm depreciates its fixed assets at the rate of $2,000 per month. All other selling and administrative costs amount to $15,000 per month.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Cost Management Measuring, Monitoring and Motivating Performance

ISBN: 978-1119185697

3rd Canadian edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott, Liang Hsuan Chen, Gail Cook