The current price of a nondividend-paying stock is 40 and the continuously compounded risk-free interest rate is

Question:

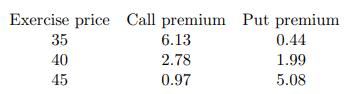

The current price of a nondividend-paying stock is 40 and the continuously compounded risk-free interest rate is 8%. The following table shows call and put option premiums for three-month European options of various exercise prices:

A trader interested in speculating on volatility in the stock price is considering two investment strategies. The first is a 40-strike straddle. The second is a strangle consisting of a 35-strike put and a 45-strike call. Determine the range of stock prices in 3 months for which the strangle outperforms the straddle.

(A) The strangle never outperforms the straddle.

(B) 33.56

(C) 35.13

(D) 36.57

(E) The strangle always outperforms the straddle.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: