The payoff of a special 1-year derivative on a nondividend-paying stock is described by the following piecewise

Question:

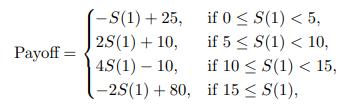

The payoff of a special 1-year derivative on a nondividend-paying stock is described by the following piecewise linear function:

where S(1) is the one-year price of the stock.

You are given:

(i) The continuously compounded risk-free interest rate is 4%.

(ii) The current stock price is 10.

(iii) The price of a 5-strike 1-year European put option is 0.11.

(iv) The price of a 10-strike 1-year European put option is 1.75.

(v) The price of a 15-strike 1-year European put option is 9.52.

(vi) The price of the above derivative is 3.60.

Describe actions you could take to exploit an arbitrage opportunity using only the above put options, stocks and zero-coupon bonds, and calculate the present value of the arbitrage profit (per unit of stock).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: