Question

1. The example in the previous chapter, National Homebuilders, Inc. evaluated cut-and-finish equipment from vendor A (6-year life) and vendor B (9-year life). The

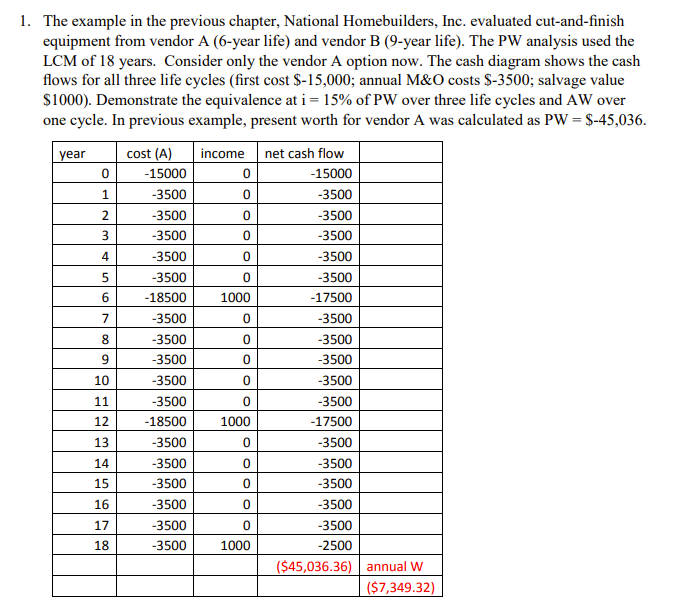

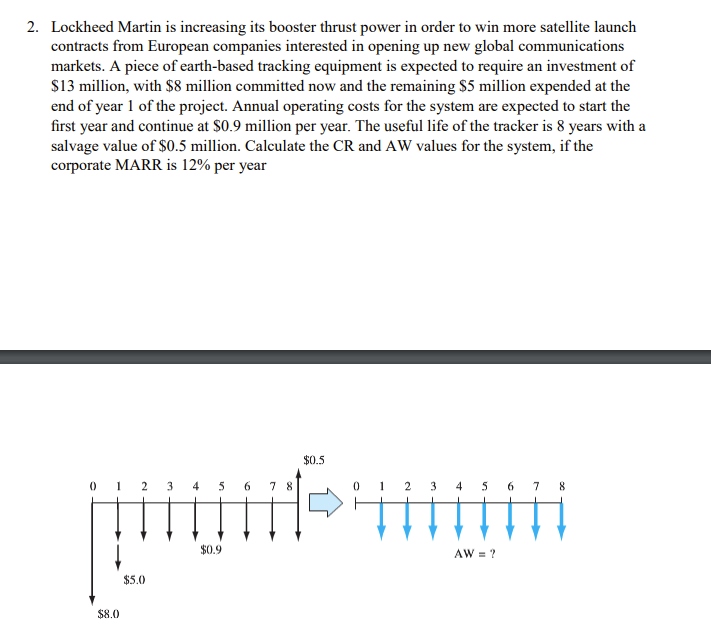

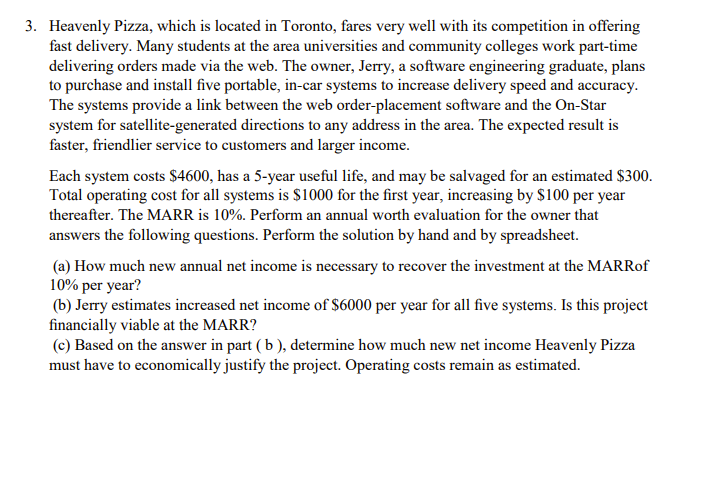

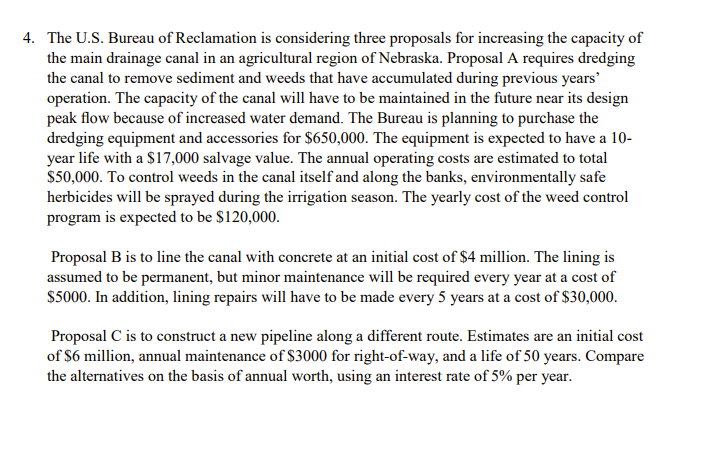

1. The example in the previous chapter, National Homebuilders, Inc. evaluated cut-and-finish equipment from vendor A (6-year life) and vendor B (9-year life). The PW analysis used the LCM of 18 years. Consider only the vendor A option now. The cash diagram shows the cash flows for all three life cycles (first cost $-15,000; annual M&O costs $-3500; salvage value $1000). Demonstrate the equivalence at i= 15% of PW over three life cycles and AW over one cycle. In previous example, present worth for vendor A was calculated as PW = $-45,036. year cost (A) income net cash flow 0 -15000 0 -15000 1 -3500 0 -3500 2 -3500 0 -3500 3 -3500 0 -3500 4 -3500 0 -3500 5 -3500 0 -3500 6 -18500 1000 -17500 7 -3500 0 -3500 8 -3500 0 -3500 9 -3500 0 -3500 10 -3500 0 -3500 11 -3500 0 -3500 12 -18500 1000 -17500 13 -3500 0 -3500 14 -3500 0 -3500 15 -3500 0 -3500 16 -3500 0 -3500 17 -3500 0 -3500 18 -3500 1000 -2500 ($45,036.36) annual W ($7,349.32) 2. Lockheed Martin is increasing its booster thrust power in order to win more satellite launch contracts from European companies interested in opening up new global communications markets. A piece of earth-based tracking equipment is expected to require an investment of $13 million, with $8 million committed now and the remaining $5 million expended at the end of year 1 of the project. Annual operating costs for the system are expected to start the first year and continue at $0.9 million per year. The useful life of the tracker is 8 years with a salvage value of $0.5 million. Calculate the CR and AW values for the system, if the corporate MARR is 12% per year 0 1 2 3 4 5 6 7 8 $8.0 $0.9 $5.0 $0.5 1 2 3 45678 AW= ? 3. Heavenly Pizza, which is located in Toronto, fares very well with its competition in offering fast delivery. Many students at the area universities and community colleges work part-time delivering orders made via the web. The owner, Jerry, a software engineering graduate, plans to purchase and install five portable, in-car systems to increase delivery speed and accuracy. The systems provide a link between the web order-placement software and the On-Star system for satellite-generated directions to any address in the area. The expected result is faster, friendlier service to customers and larger income. Each system costs $4600, has a 5-year useful life, and may be salvaged for an estimated $300. Total operating cost for all systems is $1000 for the first year, increasing by $100 per year thereafter. The MARR is 10%. Perform an annual worth evaluation for the owner that answers the following questions. Perform the solution by hand and by spreadsheet. (a) How much new annual net income is necessary to recover the investment at the MARRof 10% per year? (b) Jerry estimates increased net income of $6000 per year for all five systems. Is this project financially viable at the MARR? (c) Based on the answer in part (b), determine how much new net income Heavenly Pizza must have to economically justify the project. Operating costs remain as estimated. 4. The U.S. Bureau of Reclamation is considering three proposals for increasing the capacity of the main drainage canal in an agricultural region of Nebraska. Proposal A requires dredging the canal to remove sediment and weeds that have accumulated during previous years' operation. The capacity of the canal will have to be maintained in the future near its design peak flow because of increased water demand. The Bureau is planning to purchase the dredging equipment and accessories for $650,000. The equipment is expected to have a 10- year life with a $17,000 salvage value. The annual operating costs are estimated to total $50,000. To control weeds in the canal itself and along the banks, environmentally safe herbicides will be sprayed during the irrigation season. The yearly cost of the weed control program is expected to be $120,000. Proposal B is to line the canal with concrete at an initial cost of $4 million. The lining is assumed to be permanent, but minor maintenance will be required every year at a cost of $5000. In addition, lining repairs will have to be made every 5 years at a cost of $30,000. Proposal C is to construct a new pipeline along a different route. Estimates are an initial cost of $6 million, annual maintenance of $3000 for right-of-way, and a life of 50 years. Compare the alternatives on the basis of annual worth, using an interest rate of 5% per year. 5. In the 1860s, General Mills Inc. and Pillsbury Inc. both started in the flour business in the Twin Cities of Minneapolis-St. Paul, Minnesota. In the decade of 2000 to 2010, General Mills purchased Pillsbury for a combination cash and stock deal worth more than $10 billion and integrated the product lines. Food engineers, food designers, and food safety experts made many cost estimates as they determined the needs of consumers and the combined company's ability to technologically and safely produce and market new food products. At this point only cost estimates have been addressed-no revenues or profits. Assume that the major cost estimates below have been made based on a 6-month study about two new products that could have a 10-year life span for the company. Use LCC analysis at the industry MARR of 18% to determine the size of the commitment in AW terms. (Time is indicated in product-years. Since all estimates are for costs, they are not preceded by a minus sign.) Consumer habits study (year 0) Preliminary food product design (year 1) Preliminary equipment/plant design (year 1) Detail product designs and test marketing (years 1, 2) Detail equipment/plant design (year 2) Equipment acquisition (years 1 and 2) Current equipment upgrades (year 2) New equipment purchases (years 4 and 8) Annual equipment operating cost (AOC) (years 3 - 10) Marketing year 2 years 3-10 year 5 | $0.5 million 0.9 million 0.5 million 1.5 million each year 1.0 million $2.0 million each year | 1.75 million | 2.0 million (year 4) 10% per purchase thereafter 200,000 (year 3)+4% per year thereafter $8.0 million 5.0 million (year 3) and0.2 million per year thereafter only 3.0 million extra Human resources, 100 new employees for 2000 hours per $20 per hour (year 3) +5% per year (years 3-10 Phase-out and disposal (years 9 and 10) year | $1.0 million each year LCC analysis can get complicated rapidly due to the number of elements involved. Calculate the PW by phase and stage, add all PW values, then find the AW over 10 years. Values are in $1 million units.

Step by Step Solution

There are 3 Steps involved in it

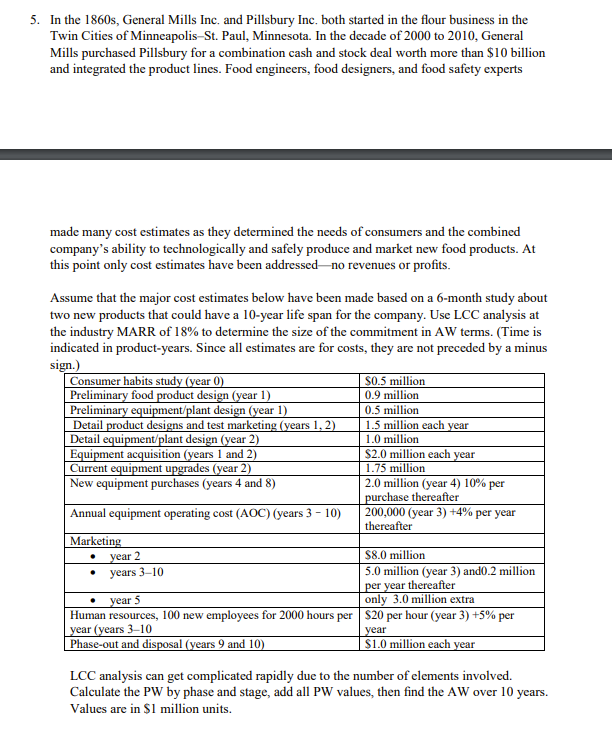

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started