We examine the pricing of a semiannual pay, one-year credit default swap (CDS). The premium payments are

Question:

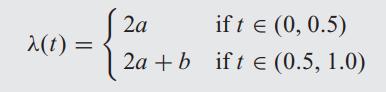

We examine the pricing of a semiannual pay, one-year credit default swap (CDS). The premium payments are made at the beginning of each semiannual period, and default payments are made at the end of each period. The default intensity is given by the following function

The CDS spreads for a half year and one year are

![]()

The risk-free rate is r = 0.01 and the recovery rate is φ = 0.6. Recovery is a fraction of par. Solve for a, b assuming the CDS contracts are fairly priced.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: