Question: Estimating the capital asset pricing model (CAPM). In Section 6.1 we considered briefly the well-known capital asset pricing model of modern portfolio theory. In empirical

Stage I (Time-series regression). For each of the N securities included in the sample, we run the following regression over time:

Rit = α̂i + β̂i Rmt + eit €¦€¦€¦€¦€¦€¦. (1)

where Rit and Rmt are the rates of return on the ith security and on the market portfolio (say, the S&P 500) in year t; βi , as noted elsewhere, is the Beta or market volatility coefficient of the ith security, and eit are the residuals. In all there are N such regressions, one for each security, giving therefore N estimates of βi.

Stage II (Cross-section regression). In this stage we run the following regression over the N securities:

RÌ…i = γ̂1 + γ̂2 β̂i + ui €¦€¦€¦€¦€¦€¦.. (2)

where R̅i is the average or mean rate of return for security i computed over the sample period covered by Stage I, β̂i is the estimated beta coefficient from the first-stage regression, and ui is the residual term.

Comparing the second-stage regression (2) with the CAPM Eq. (6.1.2), written as

ERi = rf + βi(ERm ˆ’ rf ) €¦€¦€¦€¦.. (3)

where rf is the risk-free rate of return, we see that γ̂1 is an estimate of rf and γ̂2 is an estimate of (ERm ˆ’ rf ), the market risk premium.

Thus, in the empirical testing of CAPM, R̅i and β̂i are used as estimators of ERi and βi, respectively. Now if CAPM holds, statistically,

γ̂1 = rf

γ̂2 = Rm ˆ’ rf, the estimator of (ERm ˆ’ rf)

Next consider an alternative model:

RÌ…i = γ̂1 + γ̂2 β̂i + γ̂3s2ei + ui €¦€¦€¦€¦€¦. (4)

where s2ei is the residual variance of the ith security from the first-stage regression.

Then, if CAPM is valid, γˆ3 should not be significantly different from zero.

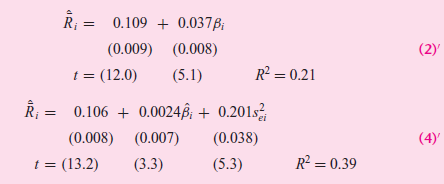

To test the CAPM, Levy ran regressions (2) and (4) on a sample of 101 stocks for the period 1948€“1968 and obtained the following results:

a. Are these results supportive of the CAPM?

b. Is it worth adding the variable s2ei to the model? How do you know?

c. If the CAPM holds, γ̂1 in (2)' should approximate the average value of the risk free rate, rf. The estimated value is 10.9 percent. Does this seem a reasonable estimate of the risk-free rate of return during the observation period, 1948€“1968? (You may consider the rate of return on Treasury bills or a similar comparatively risk-free asset.)

d. If the CAPM holds, the market risk premium ( RÌ…m ˆ’ rf ) from (2)' is about 3.7 percent. If rf is assumed to be 10.9 percent, this implies RÌ…m for the sample period was about 14.6 percent. Does this sound like a reasonable estimate?

e. What can you say about the CAPM generally?

0.109 + 0.037i Ri %3D (0.009) (0.008) (2) R = 0.21 t = (12.0) (5.1) ; = 0.106 + 0.0024; + 0.201s, (4) (0.008) (0.007) (0.038) R = 0.39 (3.3) t = (13.2) (5.3) I|

Step by Step Solution

3.53 Rating (173 Votes )

There are 3 Steps involved in it

a No The estimated 3 is significantly different from zero as its t value is 53 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1529_605d88e1d0489_656448.pdf

180 KBs PDF File

1529_605d88e1d0489_656448.docx

120 KBs Word File