Four investment alternatives (A, B, C, and D) are under consideration. The present worth (PW) for each

Question:

Four investment alternatives (A, B, C, and D) are under consideration. The present worth (PW) for each alternative is $187,500, $300,000, $225,000, and $262,500. The payback periods (PP) for the alternatives were 2, 3, 1, and 4 years. The risk levels (RL) associated with each alternative are quite different, with A being most risky, D being least risky, and B and C being equally risky. The weights for PW, PP, and RL have been assigned as 35, 40, and 25.

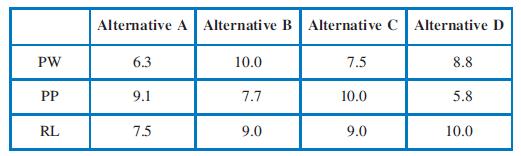

The following ratings have been assigned to each alternative for each factor:

a. Using the weighted factor comparison method, which alternative would be recommended?

b. What is the imputed value, in terms of present worth, for the difference in payback period for Alternatives B and C?

c. Of the ten principles, which one(s) is well illustrated by this problem?

d. Of the systematic economic analysis technique’s seven steps, which one(s) is well illustrated by this problem?

Step by Step Answer:

Principles Of Engineering Economic Analysis

ISBN: 9781118163832

6th Edition

Authors: John A. White, Kenneth E. Case, David B. Pratt