Continue with the Holmstrm-Tirole model from Section 3.3. Keeping all the settings unchanged and assuming that the

Question:

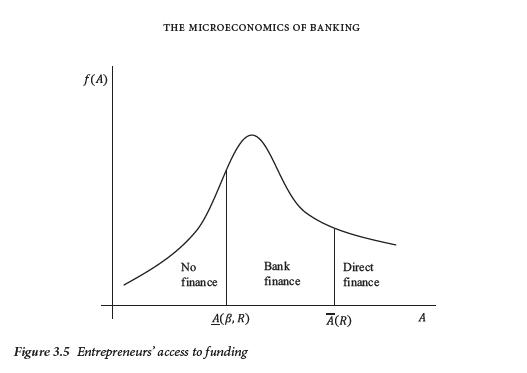

Continue with the Holmström-Tirole model from Section 3.3. Keeping all the settings unchanged and assuming that the credit market is segmented as Figure 3.5 shows, with \(\underline{A}(\beta, R)

(a) Suppose, at this stage, the risk-free rate \(R\) is exogenously set by the central bank, but shareholders' required ROE, \(\beta\), is endogenized by the demand and supply of bank capital. Define the cumulative distribution function (cdf) of entrepreneurs' initial wealth \(A\) as \(F(A)\).

i. Characterize the aggregate demand for bank capital.

ii. Assume that bank shareholders' aggregate supply of bank capital is a fixed volume \(\overline{L_{B}}\). Characterize how equilibrium \(\beta\) is affected by the value of \(\overline{L_{B}}\).

iii. Discuss the market outcomes after an exogenous "capital flight", i.e., a fall in \(\overline{L_{B}}\).

(b) Now suppose that the risk-free rate \(R\) is also endogenized, by the supply from and demand for the funding provided by the consumers. Assume that consumers' aggregate funding supply to the credit market, \(S(R)\), is a strictly increasing function of \(R\).

i. Characterize the aggregate demand for consumers' funding.

ii. Combining the result from question (a) ii, characterize how equilibrium \(\beta\) and \(R\) are jointly determined.

iii. Discuss the market outcomes after an exogenous "saving glut', i.e., an increase in \(S\).

Step by Step Answer: