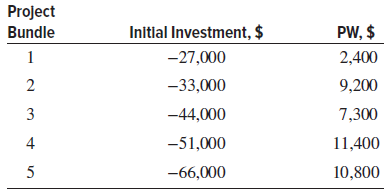

Question: An engineer at Suncore Micro, LLC calculated the present worth of mutually exclusive bundles, each comprised of one or more independent projects. (a) Select the

(a) Select the acceptable bundle if the capital investment limit is $50,000 and the MARR is 15% per year.

(b) What happens to any leftover capital if not all of the $50,000 is committed to the selected bundle?

Project Initlal Investment, $ PW, $ Bundle -27,000 2,400 -33,000 9,200 3 -44,000 7,300 4 -51,000 11,400 10,800 -66,000

Step by Step Solution

3.30 Rating (162 Votes )

There are 3 Steps involved in it

a Select the bundle with the largest pos... View full answer

Get step-by-step solutions from verified subject matter experts