Question: In problem 9.38, Mosaic Software could invest $10,000,000 over a 6 year period with a net cash flow estimate of $1,115,000 per year. The equity

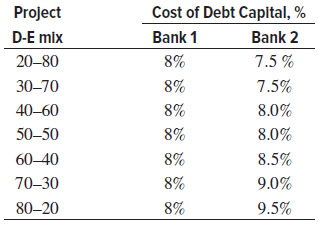

In problem 9.38, Mosaic Software could invest $10,000,000 over a 6 year period with a net cash flow estimate of $1,115,000 per year. The equity portion of the investment will cost 9.25% per year; however, the debt portion can vary from 20% to 80% of the total amount, and the required loan rate may change with increasing amounts of debt financing. After an important meeting with the loan officers of the two prime lending banks, the CFO of Mosaic formulated scenarios Bank 1 and Bank 2 for funding the project with different D-E mixes. Develop the WACC curves using a spreadsheet for each scenario and determine if the project is economically justified based on equity financing provided the MARR is set equal to the WACC

(a) For the D-E mix of 50%€“50%,

(b) For each funding scenario.

Problem 9.38

Mosaic Software has an opportunity to invest $10,000,000 in a new engineering remote-control system for offshore drilling platforms in partnership with two other companies. Financing for Mosaic will be split between common stock sales ($5,000,000) and a loan with an 8% per year interest rate. Mosaic€™s share of the annual net cash flow is estimated to be $1,115,000 for each of the next 6 years. Mosaic is about to initiate CAPM as its common stock evaluation model. Recent analysis shows that it has a volatility rating of 1.05 and is paying a premium of 5% common stock dividend. Risk-free government bond investments are currently paying 4% per year.

Cost of Debt Capltal, % Project Bank 1 D-E mlx Bank 2 7.5 % 20-80 8% 8% 7.5% 3070 8% 8.0% 4060 8.0% 5050 8% 8% 8.5% 60-40 8% 9.0% 7030 8% 9.5% 8020

Step by Step Solution

3.53 Rating (174 Votes )

There are 3 Steps involved in it

a Project i 9012 for the 5050 DE mix where 5000000 in equity is required See cells F6 and K6 Project ... View full answer

Get step-by-step solutions from verified subject matter experts