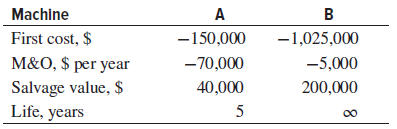

Question: The two machines shown are being considered for a chip manufacturing operation. Assume the MARR is a real return of 12% per year and that

(a) Constant-value dollars,

(b) future dollars? Solve by hand and using a spreadsheet.

Machine First cost, $ M&O, $ per year Salvage value, $ Life, years B -150,000 -1,025,000 -70,000 -5,000 40,000 5 200,000

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

By hand a For CV dollars use i 12 per year AW A 150000AP125 70000 40000AF12... View full answer

Get step-by-step solutions from verified subject matter experts