As director of equity research at a brokerage, you have final responsibility in the choice of valuation

Question:

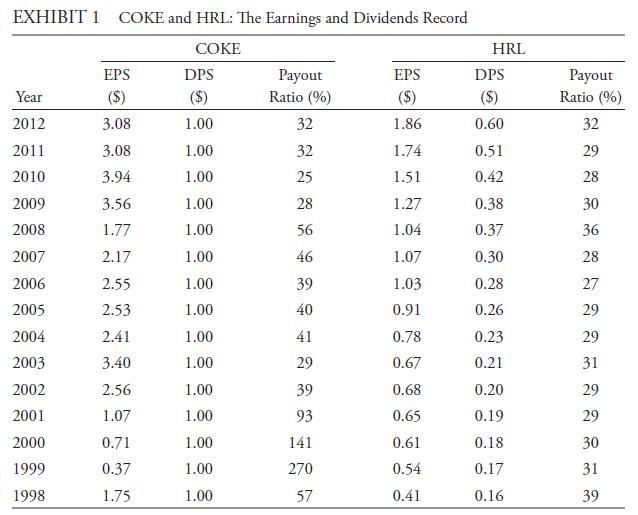

As director of equity research at a brokerage, you have final responsibility in the choice of valuation models. An analyst covering consumeron-cyclicals has approached you about the use of a dividend discount model for valuing the equity of two companies: Coca-Cola Bottling Company Consolidated (NASDAQ: COKE) and Hormel Foods (NYSE: HRL). Exhibit 1 gives the most recent 15 years of data. (In the table, EPS is earnings per share, DPS is dividends per share, and payout ratio is DPS divided by EPS.)

Answer the following questions based on the information in Exhibit 1:

i. State whether a dividend discount model is an appropriate choice for valuing COKE. Explain your answer.

ii. State whether a dividend discount model is an appropriate choice for valuing HRL. Explain your answer.

Step by Step Answer: