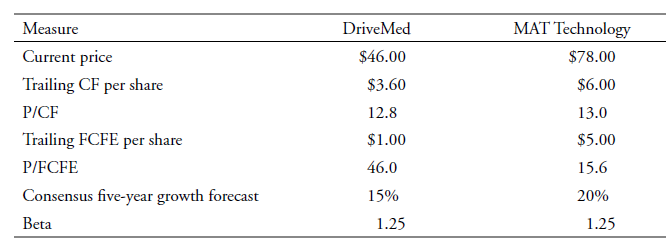

Data for two hypothetical companies in the pharmaceutical industry, DriveMed and MAT Technology, are given in the

Question:

On the basis of the information supplied, discuss the valuation of MAT Technology relative to DriveMed. Justify your conclusion.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Equity Asset Valuation

ISBN: 978-0470571439

2nd Edition

Authors: Jerald E. Pinto, Elaine Henry, Thomas R. Robinson, John D. Stowe, Abby Cohen

Question Posted: