Diana Rosato, CFA, is considering an investment in Taiwan Semiconductor Manufacturing Ltd., a manufacturer and marketer of

Question:

Diana Rosato, CFA, is considering an investment in Taiwan Semiconductor Manufacturing Ltd., a manufacturer and marketer of integrated circuits. Listed on the Taiwan Stock Exchange

(Code: 2330), the company’s stock is also traded on the New York Stock Exchange

(NYSE: TSM). Rosato obtained the following facts and estimates as of August 2013:

• Current price equals TWD95.6.

• Cost of equity equals 12 percent.

• Taiwan Semiconductor’s ROE has ranged from 18 percent to 22.9 percent during the period 2008–2012. The only time ROE was below 20 percent during that time period was in 2009.

• In 2012 the company paid a cash dividend of TWD2.9995.

• Book value per share was TWD28.8517 at the end of 2012.

• Rosato’s forecasts of EPS are TWD7.162 for 2013 and TWD8.356 for 2014. She expects dividends of TWD2.9995 for 2013 and TWD3.2995 for 2014.

• Rosato expects Taiwan Semiconductor’s ROE to be 25 percent from 2015 through 2019 and then decline to 20 percent through 2032.

• For the period after 2014, Rosato assumes an earnings retention ratio of 60 percent.

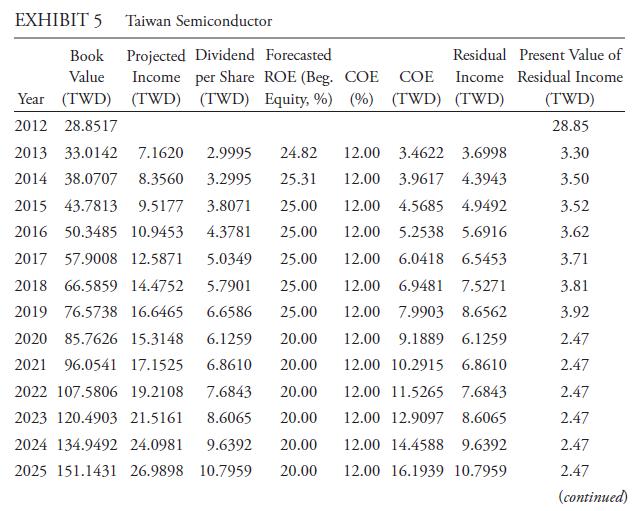

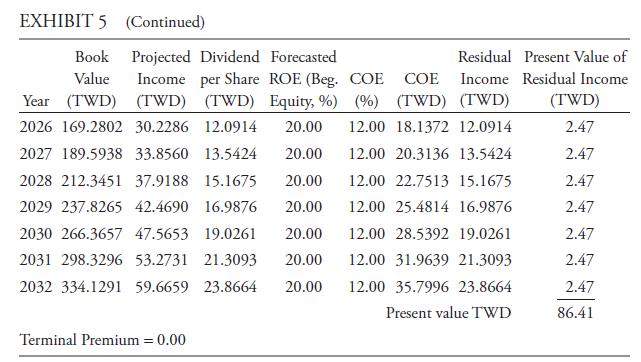

• Rosato assumes that after 2032, ROE will be 12 percent and residual income will be zero; therefore, the terminal value would be zero. Rosato’s residual income model is shown in Exhibit 5.

The market price of TWD95.6 exceeds the estimated value of TWD86.41. The market price reflects higher forecasts of residual income during the period to 2032, a higher terminal premium than Rosato forecasts, and/or a lower cost of equity. If Rosato is confident in her forecasts, she may conclude that the company is overvalued in the current marketplace.

Step by Step Answer: