Question: 3 . For LaForge Systems, whose financial statements are given in problem 2 , show the adjustments from the current levels of CFO ( which

For LaForge Systems, whose financial statements are given in problem show the adjustments from the current levels of CFO which is $ million EBIT $ million and EBITDA $ million to find

A FCFF

B FCFE.

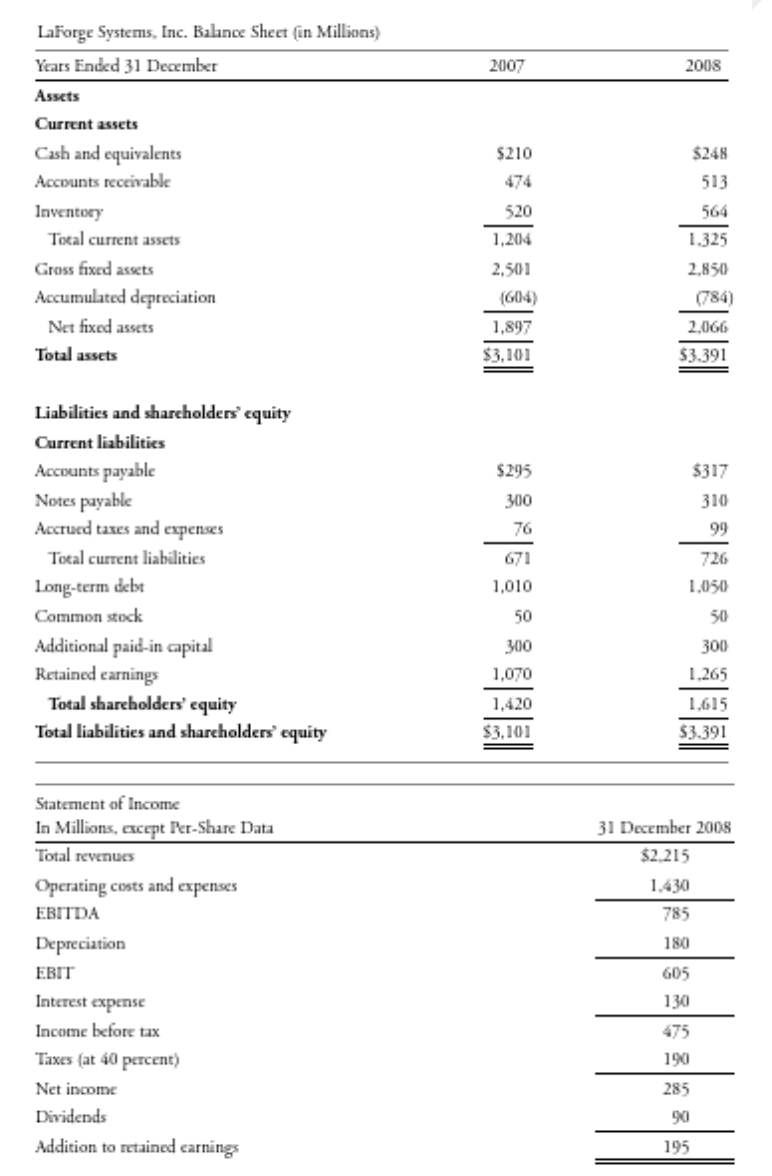

image below of information from question to help awnser question

LaForge Systems, Inc. Balance Sheet in Millions

Liabilities and shareholders' equity

Operating activities

Net income

Adjustments

Depreciation

Changes in working capital

Accounts receivable

Inventories

Accounts payable

Accrued taxes and expenses

Cash provided by operating activities

Investing activitics

Purchases of frixed assets

Cash used for investing activitics

Financing activitics

Notes payable

Longterm financing issuances

Common stock dividends

Cash used for financing activities

Cash and equivalents increase decrease

Cash and equivalents at beginning of year

Cash and equivalents at end of year

Supplemental cash flow disclosures

Interest paid

Income taxes paid

Note: The statement of cash flows shows the use of a convention by which the positive numbers of $ and $ for cash used for imrsting activitios and cash used for financing activitics, respectively, are understood to be subtractions, because "cash wed" is an oatflow.

For LaForge Systems, whose financial statements are given in Problem show the adjustments from the current levels of CFO which is $ million EBIT $ million and EBITDA $ million to find:

A FCFF:

B FCFE.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock