Question: 3. For LaForge Systems, whose financial statements are given in problem 2, show the adjustments from the current levels of CFO (which is $427 million),

3. For LaForge Systems, whose financial statements are given in problem 2, show the adjustments from the current levels of CFO (which is $427 million), EBIT ($605 million), and EBITDA ($785 million) to find

A. FCFF.

B. FCFE.

***SEE IMAGE BELOW FOR DETAILS ON Q2. TO ANSWER QUESTION 3 ABOVE.

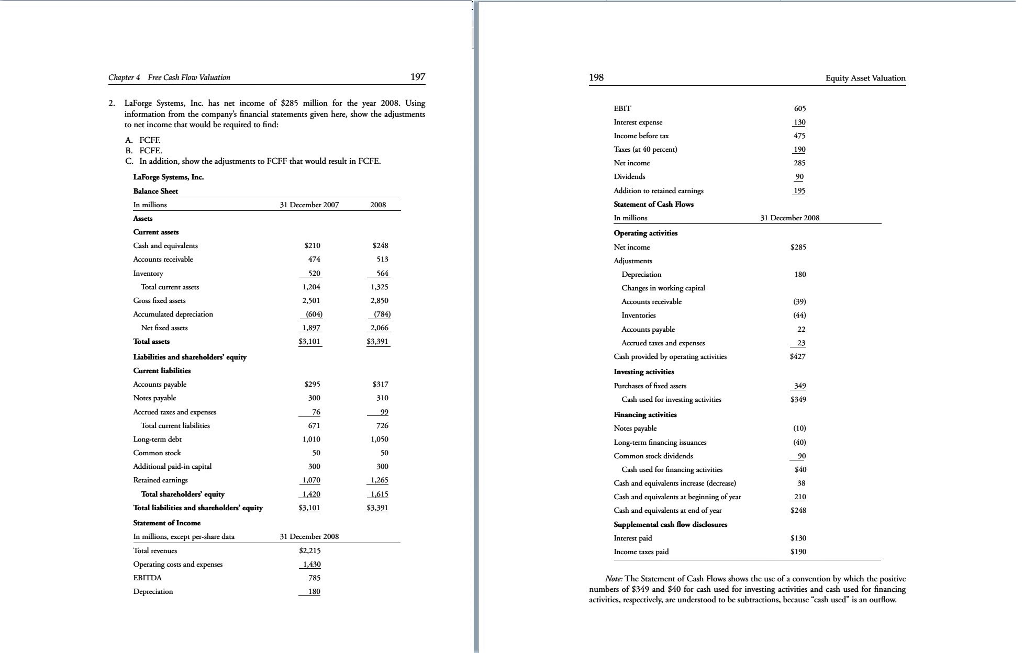

197 198 Equity Asset Valuation 2. Laforge Systems, Inc. has net income of $285 million for the year 2008. Using information from tbe company's inancial statements given here, show the adjustments to ner income char would he required to find A rCET A. FCF C. In addition, show the adjustments to FCFF that would result in FCFE HISIT Interest expense Incnme before tn Taus (40 percent) Ner income LaForge Systems, Inc Balance Sheet In millions Additian t" retained earnin Scatement of Cash Flows In millions Operating activities Net income 31 Decemher 2007 31 Dermher 2008 Current assers 5210 5248 5285 Accounts receivate 513 1,204 1,325 Changes in working apiral 2,301 2,850 Accumulaxed depreciacion (i-4) Accounes payable Acd and expenses Total asses $3,101 3,391 Liabilities and shareholders' equiy urrent liabilitie Investing activities Accounts payable 5549 Accrned rances and espenses loal ureat liabiliti Nooes payable Long-tem financing isuaIc Common stock dividends (L0) Long-tena debt 1,050 Addlioul pad-in pil Rerained earnings G00 Cash and equivalents increase (decrease) Cash and eva beginning of year Cash and equivalens a end of year 38 Total shareholders equity Total liabilities and sharehalden'eqaity Statement of Income $3,101 $3.391 248 31 euembe 2008 $2 215 Interest paid $130 Income paid Operaing costs and expeses Nur The State'nt of Cash Flowsshows [lic uscaf or,vention by which the positive numbers of $i9 and $A0 fot cash used for investing activities and cash used for financing activities nspecriwely, ane understood to be subtractions, bcause "sh sel is an outflow. 197 198 Equity Asset Valuation 2. Laforge Systems, Inc. has net income of $285 million for the year 2008. Using information from tbe company's inancial statements given here, show the adjustments to ner income char would he required to find A rCET A. FCF C. In addition, show the adjustments to FCFF that would result in FCFE HISIT Interest expense Incnme before tn Taus (40 percent) Ner income LaForge Systems, Inc Balance Sheet In millions Additian t" retained earnin Scatement of Cash Flows In millions Operating activities Net income 31 Decemher 2007 31 Dermher 2008 Current assers 5210 5248 5285 Accounts receivate 513 1,204 1,325 Changes in working apiral 2,301 2,850 Accumulaxed depreciacion (i-4) Accounes payable Acd and expenses Total asses $3,101 3,391 Liabilities and shareholders' equiy urrent liabilitie Investing activities Accounts payable 5549 Accrned rances and espenses loal ureat liabiliti Nooes payable Long-tem financing isuaIc Common stock dividends (L0) Long-tena debt 1,050 Addlioul pad-in pil Rerained earnings G00 Cash and equivalents increase (decrease) Cash and eva beginning of year Cash and equivalens a end of year 38 Total shareholders equity Total liabilities and sharehalden'eqaity Statement of Income $3,101 $3.391 248 31 euembe 2008 $2 215 Interest paid $130 Income paid Operaing costs and expeses Nur The State'nt of Cash Flowsshows [lic uscaf or,vention by which the positive numbers of $i9 and $A0 fot cash used for investing activities and cash used for financing activities nspecriwely, ane understood to be subtractions, bcause "sh sel is an outflow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts