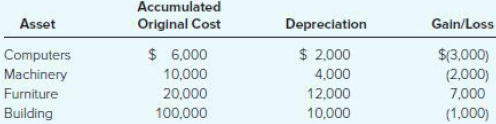

Buckley, an individual, began business two years ago and has never sold a §1231 asset. Buckley has

Question:

Assuming Buckley€™s marginal ordinary income tax rate is 32 percent, answer the questions for the following alternative scenarios:

Assuming Buckley€™s marginal ordinary income tax rate is 32 percent, answer the questions for the following alternative scenarios:

a. What is the character of Buckley€™s gains or losses for the current year? What effect do the gains and losses have on Buckley€™s tax liability?

b. Assume that the amount realized increased so that the building was sold at a $6,000 gain instead. What is the character of Buckley€™s gains or losses for the current year? What effect do the gains and losses have on Buckley€™s tax liability?

c. Assume that the amount realized increased so that the building was sold at a $15,000 gain instead. What is the character of Buckley€™s gains or losses for the current year? What effect do the gains and losses have on Buckley€™s tax liability?

Step by Step Answer:

Essentials Of Federal Taxation 2019

ISBN: 9781260190045

10th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver