The Association of Women in Government established an Educational Foundation to raise money to support scholarship and

Question:

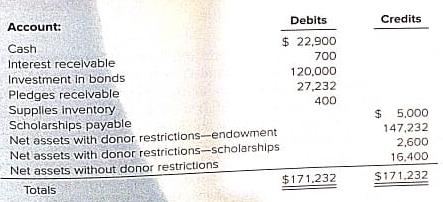

The Association of Women in Government established an Educational Foundation to raise money to support scholarship and other education initiatives. The Educational Foundation is a private not-for-profit. Members of the Association of Women in Government periodically make donations to the Educational Foundation. With the exception of the gift described below, these are unrestricted. In December 2019, a donor established a permanent endowment with an initial payment of $120,000 and a pledge to provide $10,000 per year for 3 years, beginning in December 2020. At the time, the pledge was recorded at the present value ($27,232), discounted at 5 percent. Earnings of the endowment (interest and investment gains) are derived from investment in AAA-rated corporate bonds and are restricted for the payment of scholarships. At the end of 2019, the organization had the following account balances:

The following took place during 2020:

1. The Educational Foundation has no employees. Administrative costs are limited to supplies, postage, and photocopying. Postage and photocopying expenses (paid in cash) totaled $1,980 for the year. The Foundation purchased supplies of $1,900 on account and made payments of $1,700. Unused supplies at year-end totaled $510.

2. Unrestricted donations received totaled $9,600.

3. Interest received on the bonds totaled $6,800, which included amounts receivable at the end of 2019. Accrued interest receivable at December 31, 2020, totaled $600.

4. The fair value of the bonds at year-end was determined to be $123,400. Income, including increases in the value of endowment investments, may be used for scholarships in the year earned.

5. The donor who established the permanent endowment made the scheduled payment of $10,000 at the end of 2020. (Hint: First record the increase in the present value of the pledge and then record the receipt of the $10,000.)

6. New scholarships were awarded in the amount of $17,000. Payments of scholarships (including those amounts accrued at the end of the previous year) totaled $19,500 during the year. Consistent with FASB standards, scholarships are assumed to be awarded first from resources provided from restricted revenues. (Hint: Add beginning temporarily restricted net assets to endowment earnings to determine the amount to reclassify from temporarily restricted net assets.)

Using the information above and the Excel template provided:

a. Prepare journal entries and post entries to the T-accounts.

b. Prepare closing entries.

c. Prepare a Statement of Activities, Statement of Financial Position, and Statement of Cash Flows for the year ending December 31, 2020.

Step by Step Answer:

Essentials Of Accounting For Governmental And Not-for-Profit Organizations

ISBN: 9781260570175

14th Edition

Authors: Paul Copley