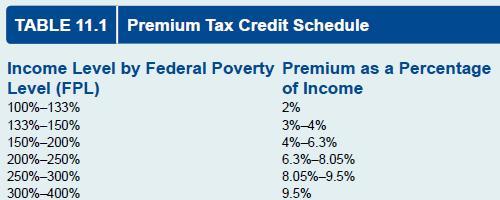

The amount of the premium tax credit is tiered based on income and is set so that

Question:

The amount of the premium tax credit is tiered based on income and is set so that individuals will not have to pay more than a certain percentage of their income for premiums (see Table 11.1). The tax credit amount is based on the cost of the second-lowest-cost silver plan in the exchange and the location where the individual is eligible to purchase insurance. Individuals who want to purchase a more expensive plan have to pay the difference in cost between the second-lowest-cost silver plan and the plan they prefer to purchase. Under the ACA, HHS will adjust the premium people are expected to pay to reflect that premium costs typically grow faster than income levels. As an example, suppose Bob’s income is 250% of the FPL (about \($32,200\) for an individual), and the cost of the second-lowest-cost silver plan in Bob’s area is \($5700.\) Under the premium tax credit schedule, Bob will pay no more than 8.05% of his income, or \($2737.\) Bob’s tax credit is \($2963,\) which is \($5700\) minus \($2737.\)

Step by Step Answer:

Essentials Of Health Policy And Law

ISBN: 9781284247459

5th Edition

Authors: Sara E. Wilensky, Joel B. Teitelbaum