Carol owns 50 percent limited partnership interests in two partnerships. Both interests are properly classified as passive

Question:

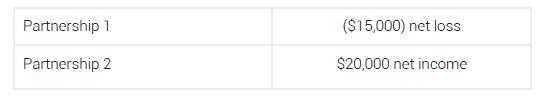

Carol owns 50 percent limited partnership interests in two partnerships. Both interests are properly classified as passive activities. This year, Carol’s share of income (loss) from each of the partnerships was as follows:

How much of the pass-through loss from Partnership 1 will Carol be allowed to deduct on her current year’s tax return? (Assume that Carol had no other income or loss from any other passive activity.)

a. $0.

b. $15,000.

c. $20,000.

d. $7,500.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Taxation Essentials Of LLCs And Partnerships

ISBN: 9781119722328

1st Edition

Authors: Larry Tunnell, Robert Ricketts

Question Posted: