The following income and expense accounts appeared in the book accounting records of Rocket Corporation, an accrual

Question:

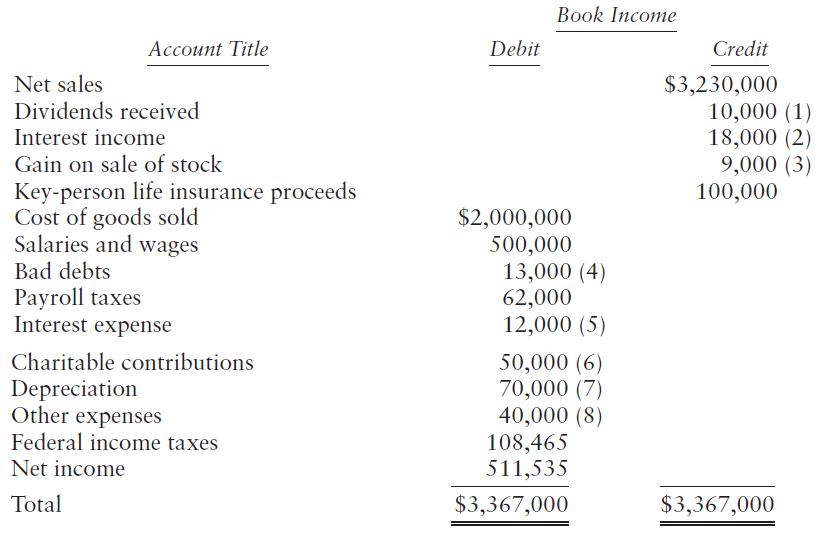

The following income and expense accounts appeared in the book accounting records of Rocket Corporation, an accrual basis taxpayer, for the current calendar year.

The following additional information applies.

1. Dividends were from Star Corporation, a 30%-owned domestic corporation.

2. Interest revenue consists of interest on corporate bonds, $15,000; and municipal bonds, $3,000.

3. The stock is a capital asset held for three years prior to sale.

4. Rocket uses the specific writeoff method of accounting for bad debts.

5. Interest expense consists of $11,000 interest incurred on funds borrowed for working capital and $1,000 interest on funds borrowed to purchase municipal bonds.

6. Rocket paid all contributions in cash during the current year to State University.

7. Rocket calculated depreciation per books using the straight-line method. For income tax purposes, depreciation amounted to $95,000.

8. Other expenses include premiums of $5,000 on the key-person life insurance policy covering Rocket’s president, who died in December.

9. Rocket has a $90,000 NOL carryover from prior years.

Required:

a. Prepare a worksheet reconciling Rocket’s book income with its taxable income (before special deductions). Six columns should be used—two (one debit and one credit) for each of the following three major headings: book income, Schedule M-1 adjustments, and taxable income. (See the sample worksheet with Form 1120 in Appendix B if you need assistance).

b. Prepare a tax provision reconciliation as in Step 9 of the Tax Provision Process. Assume a 21% corporate tax rate.

Step by Step Answer:

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

ISBN: 9780135919460

34th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse