Will, a bachelor, died in 2020. At that time, his sole asset was cash of $15 million.

Question:

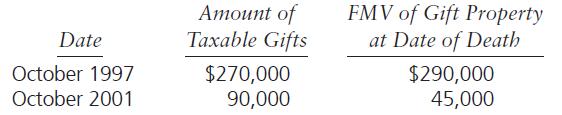

Will, a bachelor, died in 2020. At that time, his sole asset was cash of $15 million. Assume no debts or funeral and administration expenses and no charitable bequests. His gift history was as follows:

a. What was Will’s estate tax base?

b. How would your answer to Part a change if Will made the first gift in 1974 (instead of 1997)?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

ISBN: 9780135919460

34th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted: