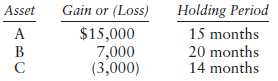

Trisha, whose tax rate is 35%, sells the following capital assets in 2016 with gains and losses

Question:

a. Determine Trisha€™s increase in tax liability as a result of the three sales. All assets arestock held for investment. Ignore the effect of increasing AGI on deductions and phaseout amounts.

b. Determine her increase in tax liability if the holding period for asset B is 8 months.

c. Determine her increase in tax liability if the holding periods are the same as in Part a but asset B is an antique clock.

d. Determine her increase in tax liability if her tax rate is 39.6%.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2017 Individuals

ISBN: 9780134420868

30th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted: