Wayne is single and has no dependents. Without considering his $11,000 adjusted net capital gain (ANCG), his

Question:

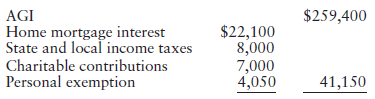

a. What is Wayne€™s tax liability without the ANCG?

b. What is Wayne€™s tax liability with the ANCG?

Transcribed Image Text:

AGI Home mortgage interest State and local income taxes |Charitable contributions Personal exemption $259,400 $22,100 8,000 7,000 4,050 41,150

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

a 555524627875 33 x 218250 190150 b 57444 Medicare tax on net investment income o...View the full answer

Answered By

Gilbert Chesire

I am a diligent writer who understands the writing conventions used in the industry and with the expertise to produce high quality papers at all times. I love to write plagiarism free work with which the grammar flows perfectly. I write both academics and articles with a lot of enthusiasm. I am always determined to put the interests of my customers before mine so as to build a cohesive environment where we can benefit from each other. I value all my clients and I pay them back by delivering the quality of work they yearn to get.

4.80+

14+ Reviews

49+ Question Solved

Related Book For

Federal Taxation 2017 Individuals

ISBN: 9780134420868

30th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Eric is single and has no dependents for 2020. He earned $60,000 and had deductions from gross income of $1,800 and itemized deductions of $12,600. Compute Erics income tax for the year using the Tax...

-

11) S'well manufactures and sells high quality, insulated water bottles made of stainless steel, in many fun colors and designs. S'well sells its water bottles to retail stores such as high-end...

-

Robert A. Kliesh, age 41, is single and has no dependents. Robert's Social Security number is 111-11-1111. His address is 201 Front Street, Missoula, MT 59812. He is independently wealthy as a result...

-

Marta purchased a home with an adjustable rate mortgage. The margin on an adjustable-rate mortgage is 5.5% and the rate cap is 6.5% over the life of the loan. If the current index rate is 8.9%, find...

-

List and define the basic organizational structures.

-

Problems 45-50 show scatter diagrams along with a best-fitting line. Match the best-fitting line in each with an appropriate equation named \(\mathrm{A}-\mathrm{H}\). A. \(y=0.5 x-4\) B. \(y=-0.5...

-

A swaption is an option to enter a swap arrangement in the future. Suppose that company B has a debt of \(\$ 10\) million financed over 6 years at a fixed rate of interest of \(8.64 \%\). Company A...

-

Shanahan Corporation produces three types of media: CDs, DVDs, and double-layer DVDs. Shanahan purchases cases for the media from a firm in Mexico and purchases the labels from another supplier in...

-

The following selected data were taken from the accounting records of Colorado Enterprises: Month Manufacturing Overhead May June July August Machine Hours 50,500 61,800 $ 934,000 1,148,000 77,000...

-

Presented below are selected transactions on the books of Simonson Corporation. May 1, 2017 Bonds payable with a par value of $900,000, which are dated January 1, 2017, are sold at 106 plus accrued...

-

Trisha, whose tax rate is 35%, sells the following capital assets in 2016 with gains and losses as shown: a. Determine Trishas increase in tax liability as a result of the three sales. All assets...

-

To better understand the rules for offsetting capital losses and how to treat capital losses carried forward, analyze the following data for an unmarried individual for the period 2013 through 2016....

-

What sorts of customers was Rent the Runway designed to appeal to? Do you think these are the only customers who would find the model appealing? Why or why not?

-

What should you remember about cross-cultural relations when you are a manager one day?

-

What document highlights critical aspects of each sustainment function and can depict critical information, such as priorities, shifts in priorities, problem areas, critical events, and other...

-

According to the Zero Emissions Buildings Framework, what is the significance of the Toronto Green Standard (TGS) in reducing building emissions?

-

What does rule 1 1 require insofar as investigating the facts of the plaintiff claim before filing? Similarity what does rule 1 1 require insofar as investigating the applicable law of plaintiff...

-

Imagine you are a manager leading a diverse team of individuals with varied cultural backgrounds, experiences, and communication styles. One of your team members consistently delivers high - quality...

-

For each function, find (a) (x + h), (b) (x + h) - (x), and (c) (x + h) - (x)/h. (x) = 2 - x

-

Assume you are the accountant for Catalina Industries. John Catalina, the owner of the company, is in a hurry to receive the financial statements for the year ended December 31, 20X1, and asks you...

-

a. What determines who must file a tax return? b. Is an individual required to file a tax return if he or she owes no tax?

-

Many homeowners itemize deductions while many renters claim the standard deduction. Explain.

-

Tax rules are often very precise. For example, a taxpayer must ordinarily provide over 50% of another persons support in order to claim a dependency exemption. Why is the threshold over 50% as...

-

All scheduled presentations and events will take place in the Main Conference Room, 1st Floor. Time February 25 Registration Guide to the Job Fair Rsum Writing Lunch (refreshments served) The...

-

You have work experience in the human resource management field. You want to further understand what factors make a project successful. You are particularly interested in employee selection and...

-

How many defects must a unit have in order to be defined as a defective unit?

Study smarter with the SolutionInn App