Using Exhibit 28.4 as a guide, describe the computation of a fiduciary entitys accounting income, taxable income,

Question:

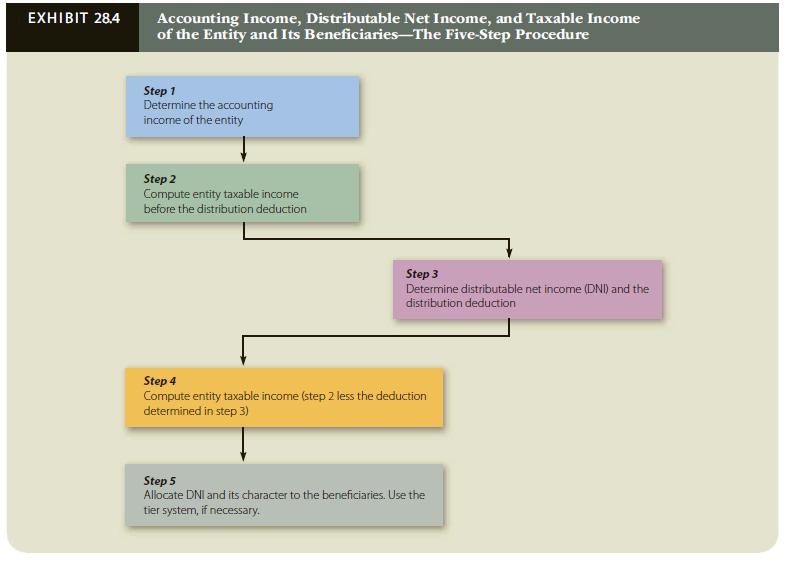

Using Exhibit 28.4 as a guide, describe the computation of a fiduciary entity’s accounting income, taxable income, and distributable net income.

Exhibit 28.4

Transcribed Image Text:

EXHIBIT 28.4 Accounting Income, Distributable Net Income, and Taxable Income of the Entity and Its Beneficiaries-The Five-Step Procedure Step 1 Determine the accounting income of the entity Step 2 Compute entity taxable income before the distribution deduction Step 3 Determine distributable net income (DNI) and the distribution deduction Step 4 Compute entity taxable income (step 2 less the deduction determined in step 3) Step 5 Allocate DNI and its character to the beneficiaries. Use the tier system, if necessary.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (10 reviews)

ANSWER Exhibit 284 outlines the fivestep procedure for computing the accounting income taxable income and distributable net income of a fiduciary enti...View the full answer

Answered By

Chandrasekhar Karri

I have tutored students in accounting at the high school and college levels. I have developed strong teaching methods, which allow me to effectively explain complex accounting concepts to students. Additionally, I am committed to helping students reach their academic goals and providing them with the necessary tools to succeed.

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Using Exhibit 20.4 as a guide, describe the computation of a fiduciary entitys accounting income, taxable income, and distributable net income. Step 1 Determine the accounting Income of the entity...

-

Describe the computation of noncontrolling interest share for an 80%-owned subsidiary with both preferred and common stock outstanding.

-

Describe the computation of free cash flow. What is its relevance to financial analysis?

-

The last two decades have taught us that when it comes to financial deregulation, it is possible to have too much of a good thing too quickly. Financial deregulation has often taken place...

-

h(x) = (2 - x2)ex. Compute the first and second derivatives of the above function.

-

A home office performs the payroll functions for Segments 1, 2, and 3 and incurs a total payroll expense of $500,000. The contractor allocates this indirect cost using a base of the number of...

-

An investor has utility function $U(x)=x^{1 / 4}$ for salary. He has a new job offer which pays $\$ 80,000$ with a bonus. The bonus will be $\$ 0, \$ 10,000, \$ 20,000$, $\$ 30,000, \$ 40,000, \$...

-

A government permits its employees to accumulate all unused vacation days and sick leave. Whereas (in accord with current standards) it may have to book a liability for the unused vacation days, it...

-

2. (a) You manage an online resource sharing platform where people can share e-books and others study materials. A typical upload/download takes ten minutes on average, and an interrupted...

-

A lash adjuster keeps pressure constant on engine valves, thereby increasing fuel efficiency in automobile engines. The relationship between price (p) and monthly demand (D) for lash adjusters made...

-

Before her death, Lucy entered into the following transactions. a. Lucy borrowed $600,000 from her brother, Irwin, so that Lucy could start a business. The loan was on open account, and no interest...

-

The Sterling Trust owns a business and generated $100,000 in depreciation deductions for the tax year. Mona is one of the income beneficiaries of the entity. a. Given the following information,...

-

Why is the length of a chain important when considering demand uncertainty in designing a supply chain network?

-

Calculate the following for the year ended January 29 2022 and January 30 2021 A. i) Gross profit ratio ii) Profit margin iii) Return on assets iv) Asset turnover (Additional information: The balance...

-

You are given $10,000 to allocate to a portfolio. You must allocate 100% of your portfolio to the following securities: 1. One hundred shares of a publicly traded company; 2. One corporate bond; 3....

-

The pharmaceutical company has recently introduced a new medication and established a dedicated production line for the creation of a particular size of the drug's pills. The diameter of the pills...

-

Evaluate the green bin proposal financially using net present value.Assume a minimum acceptable rate of return of 12 percent and a project life of 15 years. Clearly state any assumptions. Financial...

-

It is assumed that 25% of the monthly salary( including bonuses) is allocated for investment. Find the accumulated value when 100% of this monthly investment budget is invested in this bond. Find AV...

-

A gold prospector finds a solid rock that is composed solely of quartz and gold. The mass and volume of the rock are, respectively, 12.0 kg and 4.00 10-3 m3. Find the mass of the gold in the rock.

-

Keating & Partners is a law firm specializing in labour relations and employee-related work. It employs 25 professionals (5 partners and 20 managers) who work directly with its clients. The average...

-

Rosas employer has instituted a flexible benefits program. Rosa will use the plan to pay for her daughters dental expenses and other medical expenses that are not covered by health insurance. Rosa is...

-

How does the tax benefit rule apply in the following cases? a. In 2012, the Orange Furniture Store, an accrual method taxpayer, sold furniture on credit for $1,000 to Sammy. The cost of the furniture...

-

Alfred E. Old and Beulah A. Crane, each age 42, married on September 7, 2011. Alfred and Beulah will file a joint return for 2013. Alfreds Social Security number is 111-11- 1111. Beulahs Social...

-

Create a segmentation, selection and focus model that allows the PUMA company in Mexico to determine its customer, where to find it and how to generate value given its model. 7) Selection of the most...

-

Determine if the following values are zeroes polynomial. 4 3 f(x) = x + x-18x - 16x + 32 x+1, +2, +4 -

-

Cali Windows is a small company that installs windows. Its cost structure is as follows: (Click the icon to view the cost structure.) Calculate (a) the breakeven point in units and revenues and (b)...

Study smarter with the SolutionInn App