Question: P5-69A. (Learning Objective 5: Using ratio data to evaluate a companys financial position) The comparative financial statements of Highland Pools, Inc., for 20X7, 20X6, and

P5-69A. (Learning Objective 5: Using ratio data to evaluate a company’s financial position)

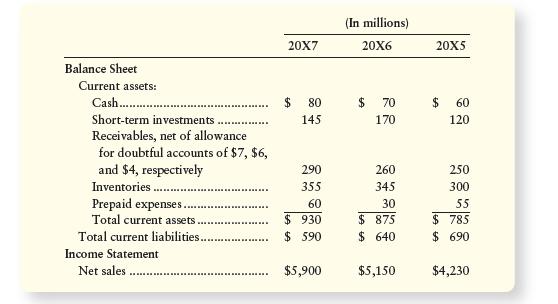

The comparative financial statements of Highland Pools, Inc., for 20X7, 20X6, and 20X5 included the following select data:

Requirements 1. Compute current ratio and days’ sales in receivables for 20X7 and 20X6:

2. Which ratio(s) improved from 20X6 to 20X7 and which ratio(s) deteriorated? Is this trend favorable or unfavorable?

Balance Sheet 20X7 (In millions) 20X6 20X5 Current assets: Cash....... Short-term investments $ 80 $ 70 $ 60 145 170 120 RR Receivables, net of allowance for doubtful accounts of $7, $6, and $4, respectively 290 260 250 Inventories.......... 355 345 300 Prepaid expenses.. 60 30 55 Total current assets $ 930 $ 875 $ 785 Total current liabilities.. $ 590 $ 640 $ 690 Income Statement Net sales $5,900 $5,150 $4,230

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts