Question: P5-78B. (Learning Objective 5: Using ratio data to evaluate a companys financial position) The comparative financial statements of Gold Pools, Inc., for 20X7, 20X6, and

P5-78B. (Learning Objective 5: Using ratio data to evaluate a company’s financial position)

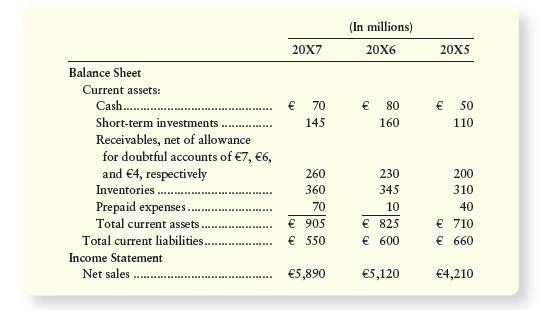

The comparative financial statements of Gold Pools, Inc., for 20X7, 20X6, and 20X5 included the following select data:

Requirements 1. Compute current ratio and days’ sales in receivables for 20X7 and 20X6.

2. Which ratio(s) improved from 20X6 to 20X7 and which ratio(s) deteriorated? Is this trend favorable or unfavorable?

Balance Sheet 20X7 (In millions) 20X6 20X5 Current assets: Cash............. 70 80 50 Short-term investments 145 160 110 Receivables, net of allowance for doubtful accounts of 7, 6, and 4, respectively 260 230 200 Inventories 360 345 310 Prepaid expenses.. 70 10 40 Total current assets. 905 825 710 Total current liabilities.. 550 600 660 Income Statement Net sales......... 5,890 5,120 4,210

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts