Several transactions entered into by Travis Retail during 2021 follow: 1. Received $50,000 for wine previously sold

Question:

Several transactions entered into by Travis Retail during 2021 follow:

1. Received $50,000 for wine previously sold on account.

2. Paid $55,000 in salaries and wages.

3. Sold a building for $100,000. The building had cost $170,000, and the related accumulated depreciation at the time of sale was $55,000.

4. Declared and paid a cash dividend of $70,000.

5. Repurchased 10,000 shares of outstanding common stock at $50 per share.

6. Purchased a two-year, $100,000 fire and storm insurance policy on June 30.

7. Purchased some equipment in exchange for 1,000 shares of common stock. The stock was currently selling for $75 per share.

8. Purchased $500,000 in long-term investments.

9. Issued $200,000 face value bonds. The bonds were sold at 101.

10. Owed $30,000 in rent as of December 31.

INSTRUCTIONS:

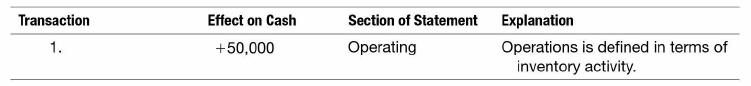

Record each transaction on a chart like the following. Classify the sections of the statement of cash flows as a cash flow from operating, investing, or financing activities. Transaction (1) is done as an example.

Step by Step Answer: