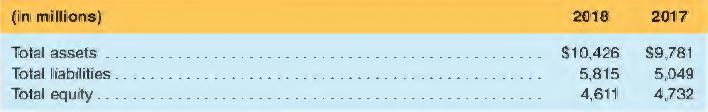

JetBlue's balance sheet and discussion of the new lease standard is as follows in their 2018 10-K:

Question:

JetBlue's balance sheet and discussion of the new lease standard is as follows in their 2018 10-K:

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842) of the Codification, which requires lessees to recognize leases on the balance sheet and disclose key information about leasing arrangements. Under the new standard, a lessee will recognize liabilities on the balance sheet, initially measured at the present value of the lease payments, and right-of-use (ROU) assets representing its right to use the underlying asset for the lease term.

For JetBlue, we believe the most significant impact of the new standard relates to the recognition of new assets and liabilities on our balance sheet for operating leases related to our aircraft, engines, airport terminal space, airport hangars, office space, and other facilities and equipment. Upon adoption, we expect to recognize additional lease assets and lease liabilities ranging from $1.0 billion to $1.4 billion.

1. If JetBlue records $1.2 billion of the operating leases as both an asset and a liability on January 1, 2019, how much will their debt-to-equity ratio from December 31, 2018, change (assume no other changes for JetBlue)?

2. If an analyst wants to compare Delta, who adopted in the fourth quarter of 20 18, to JetBlue, who is adopting in 2019, what would the analyst need to consider and do?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman