The following information was provided in the 2018 10-K of Hilton Worldwide Holdings, Inc. Note 7: Property

Question:

The following information was provided in the 2018 10-K of Hilton Worldwide Holdings, Inc.

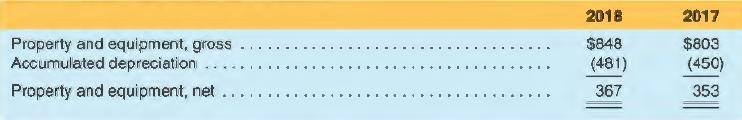

Note 7: Property and Equipment (S millions)

Note 7 also revealed that depreciation expense on property and equipment totaled $54 million in 2018. The cash flow statement reported that expenditures for property and equipment totaled $72 million in 2018 and that there was no gain or loss on the sale of property and equipment during the year.

REQUIRED:

Using the information provided, prepare a journal entry to record the sale of property and equipment in 2018. Explain how a gain or loss on the sale would have changed the journal entry you recorded.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman